Good news. Pay will soon rise faster than prices. Inflation is falling and growth is accelerating. The labor market is still strong and this is driving wage growth. It may not even be necessary to raise interest rates to curb inflation.

According to Governor Andrew Bailey of the Bank of England, «the economy has become more resilient, which is a good thing.»

The Bank's latest economic forecasts also made Rishi Sunak breathe a sigh of relief. Inflation is expected to ease sharply in the coming months as last year's energy bill shock flattens out and the overall rate hits 5% by October.

The prime minister has put the government's reputation at stake by cutting inflation in half this year. . Threadneedle Street's latest forecasts show that prices will rise by around 4.9% by the end of this year, allowing Mr. Sunak to claim victory.

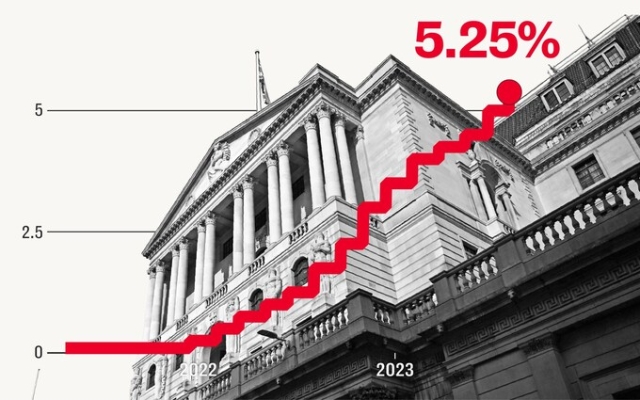

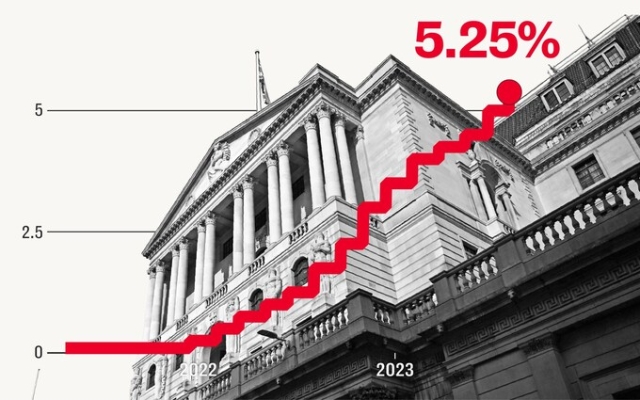

Interest rates, which have now reached 15-year even peaked.

0408 CPI inflation rate

Mr. Bailey said there are several ways to bring inflation, currently at 7.9 percent, back to the Bank's target of 2 percent. Financial markets predict that by early 2024 the base rate of the Bank of England should peak at 5.75 percent.

The manager noted that keeping interest rates unchanged at 5.25 percent would also be beneficial. “We have a choice,” he said.

But that's where the good news ends. The bank lowered its growth forecasts for the next two years and warned that about 350,000 people would be out of work. Interest rates may not need to rise to the 6.5% that financial markets were targeting just a month ago, but they will need to stay higher longer if the Bank is to quell inflation.

Mr Bailey hinted that keeping rates at 5.25% for «two or three years» was another option to reduce inflation. But a prolonged period of higher borrowing costs has implications for jobs, economic growth, mortgages and incomes, which was also reflected in the Bank's latest forecasts.

James Smith, director of research at the Resolution Foundation think tank, says: «While there is good news that real wage cuts will end sooner than expected, the cost of containing inflationary pressures from a tough UK job market is rising unemployment.» /p> 0408 Weak growth ahead

«The bank's outlook is particularly bad news for Rishi Sunak, as the bank's forecasts suggest that the likely backdrop for next year's elections will be a fall in GDP, rising unemployment and a large increase in mortgage payments.»

The weekly store's outlook are also mixed.

While the rapid rise in food prices seen earlier this year is probably a thing of the past, information from Bank agents, who serve as the Bank's eyes and ears around the world, countries suggest that by the end of this year, they will still rise by about 10%.

Bailey also warned that prices may decline more slowly than they rose.

He said: “Food price inflation is declining and will continue to decline. But it took longer than I think anyone expected. And that includes many people in the food industry.”

Bailey noted that food production is very energy intensive. He added that many farmers also fixed prices for a longer period after the start of the war to secure supplies.

«I think that's another thing that helps explain the slow passage,» Mr. Bailey told reporters. «But consistent messages, and we see it in the data now that it's happening, but it's happening later and slower.»

0408 Rising unemployment

Grant Fitzner, chief economist at the ONS, recently said British supermarkets were «notorious ” by “making tough deals”, especially when it came to negotiations with dairy farmers.

Last month, he said: «It's useful when prices are expected to fall, but less so when prices rise.» He also noted that supermarkets are focusing their discounts on products bought by people with loyalty cards as they try to fight competition from German discounters such as Lidl and Aldi.

Perhaps there are more problems ahead. The British Retail Consortium has already warned that Vladimir Putin's decision to block Ukrainian grain exports means British families will face higher food prices for longer than expected, while the International Monetary Fund believes it could drive up grain prices. 15%.

While Mr. Bailey downplays the possibility of a new wave of price hikes, he said politicians are watching.

Customers have responded by changing what they put in the weekly store . Families are buying less, switching to cheaper brands and moving from fresh to frozen. At the end of last year, Aldi overtook Morrisons to become the fourth largest supermarket in the UK.

Mortgage holders had nothing to celebrate either.

Banks and building societies weren't holding back when it came to higher borrowing costs.

MPC noted that «mortgage rates are appear to have been revalued faster than in the past,” as he pushes for a sharp and sustained monetary tightening program. affect millions of other mortgage holders.

Last month, the Bank estimates that 4.5 million households have already seen an increase in their mortgage payments since rates began to rise in late 2021, with another 4 million households affected by the end of 2021. 2026

0408 Steadily rising prices

On average, their monthly payments will rise by around £220, the bank said in July. For just over 200,000 households, the jump will be over £1,000 a month.

Families are not waiting for bills to come in to cut costs.

“Most households are likely aware that their mortgage costs will rise and therefore can anticipate this by adjusting consumption ahead of time,” the Bank’s monetary policy report says.

Still, the effect will increase over time, says Andrew Goodwin of Capital Economics, given the popularity of long-term fixed mortgages that families have taken out in recent years to lock in low borrowing costs.

“Even if the bank rate falls again, recent changes in the structure of the mortgage market means that we will see the impact of the tightening seen in the last couple of years gradually build up and not peak until 2026,” says Goodwin, describing the situation. continued pressure as “a significant setback to the economy over the next few years.”

At the same time, a sharp rise in the cost of buy-to-let mortgages could hit landlords and their tenants alike, which will affect the economy as a whole.

“It is likely that at least some of the increase in landlord borrowing costs is being passed on to tenants,” the company warns in its report.

other forms of consumption for tenant households.”

0408 The Bank predicts higher wage growth than models suggestThe bank's next move depends on where the wages go. Wages have been surprisingly rising in recent months, causing officials to throw all traditional models out the window when it comes to forecasting future wages.

Bailey highlighted this on Thursday, and Bank officials are now predicting that workers will demand higher wages for a longer period in an attempt to protect their standard of living.

Bailey said: “Surprises of higher wage inflation suggest that spillovers will take longer to dissipate than they do in response to a surge in the prices of many imported goods. Engagement with a tough labor market is expected to lead to greater sustainability of wage inflation and with it the cost pressures that drive pricing in the UK economy.”

While Bailey insists on an economic model don't break, he welcomed the revision of its forecasting processes by former Federal Reserve Chairman Ben Bernanke. Wage and service inflation, which reflects everything from restaurant bills to concert tickets, will matter most in the future.

On the subject of wages, Mr. Bailey said: «Although I would never say that only one indicator matters, it is an important point in assessing the future path.»

American political strategist James Carville coined the phrase «It's the economy, dumbass!» in 1992. Both Bailey and Sunak will hope that Thursday's path to a soft landing without a recession is now on track.

Свежие комментарии