Cast of Billions including Damian Lewis, Corey Stoll, Paul Giamatti and Maggie Siff. Photo: SHOWTIME

Cast of Billions including Damian Lewis, Corey Stoll, Paul Giamatti and Maggie Siff. Photo: SHOWTIME

Bobby Axelrod is back. Damian Lewis' ruthless homemade hedge fund returns for its seventh — and final — season of Billions this week. It promises more OTT trinkets and Macbeth-style backstabs than you can shake a stock bond.

The show is hardly known for its realism; Murder and market fraud on a global scale might look better on television than the sight of sweaty financiers hunched over glowing terminals. But does it have a real basis?

Not really. The series, which also stars Paul Giamatti as an eccentric lawyer investigating Bobby's financial affairs, is entirely fictional. But that hasn't stopped a lot of speculation about who might have inspired the series' characters.

While much of Billions may seem exaggerated on paper, hedge fund managers seem to attract drama, indulging in everything from sordid divorces and exposures of financial spending in the New York press to public showdown with George Clooney. Here are just a few of the billionaires whose real life may have inspired some of the television series.

Steve Cohen (Net value: $17.5B)

Steve Cohen (Net value: $17.5B)

While the mercurial Bobby Axelrod Damian Lewis has several real-life doppelgangers (see below), one of the most compelling is hedge fund manager Steven Cohen. Around the time Billions co-creators Andrew Ross Sorkin, Brian Koppelman, and David Levien were storyboarding the first series, Cohen was involved in a costly (and very public) controversy with U.S. Attorney Preet Bharara, who was prosecuting him on charges of insider trading. which he denied. This altercation mirrors the conflict between Axelrod and Paul Giamatti's Chuck Rhodes at the start of the season.

There are other parallels: Like Axelrod, Cohen is proud of his working-class upbringing and his origin story. He started trading in college and went on to work for a Wall Street firm, Gruntal & Co, eventually bringing in over $100,000 a day for the company.

Steve Cohen Hedge Fund Photo: Charlie Riedel

Steve Cohen Hedge Fund Photo: Charlie Riedel

He went on his own in 1992, founding SAC Capital Advisors with $10 million of his own money. Two decades later, she managed $14 billion in capital. But in 2012, one of his traders, Matthew Martom, was accused of insider trading, and the rest of the fund came under scrutiny. In 2014, Martoma was convicted of what prosecutors called the most lucrative insider trading conspiracy in history. Cohen agreed to pay a $1.8 billion fine — a record payment — and was banned from managing outside money for two years. But he was never convicted.

That didn't stop him from buying the New York Mets in 2020. He met his wife Alex Garcia through a dating app. In her profile, she said that she «always wanted to marry a millionaire.» Gotta love a woman who knows her mind.

Bill Ekman (Net Worth: $3.6 billion)

While Damian Lewis is quick to deny it, hedge fund Bill Ekman is reportedly proud to have inspired Lewis' character on Billions . Not only because both men have similar faces. “They keep coming up to me,” Lewis told the New York Post. “They say: “Akman, Axelrod. They have the same initials.» But Bobby Axelrod is not based on any real person.”

To be fair, Akman's lifestyle does indeed resemble his own prestigious cable drama. He calls himself an «activist investor,» meaning someone who uses an equity stake in a corporation to pressure its management, usually for political or environmental purposes. He is also well known in the Wall Street gossip pages, especially a few years ago for his divorce from wife Karen Ann Herskovitz, who did not sign a prenuptial agreement prior to their marriage. Subsequently, Herskovitz is believed to be entitled to half of Ekman's fortune.

Bobby Axelrod in reality? Hedge Fund Bill Ekman. Photo: Scott Ills.

Bobby Axelrod in reality? Hedge Fund Bill Ekman. Photo: Scott Ills.

As a result, Ekman enlisted the services of powerful lawyer William D. Zabel to confront his wife's representatives in court. Zabel previously resolved the divorce between former General Electric chairman Jack Welch and his wife Jane, settling on the courthouse steps when Jane walked away from the marriage with $180 million.

That personal drama has now subsided, and Ekman has been married to designer Neri Oxman since 2019. In 2019, he wrote to the Massachusetts Institute of Technology, where Oxman works, to pressure them not to disclose that his wife's lab received a $125,000 donation from Jeffrey Epstein.

Like Axelrod, he also has his own growing real estate empire in the Hamptons. In 2011, Ekman purchased a waterfront estate in Bridgehampton for $22 million, and in early 2016 additionally purchased a six-acre parcel of three separate addresses for $23 million. He also commissioned building work for the headquarters of his Pershing Square Capital Management. firm in 2015, which included the installation of a large outdoor rooftop terrace with swimming pool and tennis court. He also intended to add two additional floors to the eight-story building.

One of Ackman's estates in the Hamptons Credit: Google Earth

One of Ackman's estates in the Hamptons Credit: Google Earth

Ackman has also been involved in his own television feuds with other billionaires. The legendary battle in Wall Street circles is due to his bitter rivalry with investor and business mogul Carl Icahn, and New York hotspots are careful to keep both men separated should they ever be near each other. The feud began when Icahn pulled out of a 2003 deal that would split the profits from the sale of a real estate company between both men. Ackman sued, and eight years later he was finally awarded the money owed to him, prompting Icahn to call for a truce. But it was short-lived.

Two years later, the couple staged a duel on live television. During a CNBC phone interview, the two men feuded over Icahn's controversial medical corporation Herbalife, which Ekman publicly called a «pyramid scheme.» During a 20-minute argument, both men showered insults on each other, Icahn claiming Akman was a liar, which Akman denied.

“He has one of the worst reputations on Wall Street,” Icahn said. “I tell you, he looks like a crybaby in the schoolyard. You know, I went to a tough school in Queens and they beat up little Jewish boys. He looked like a crying Jewish boy.”

However, Ekman has proven that he also has a softer side. He signed on bail, promising to donate half of his fortune to charity for the rest of his life; and in the midst of the Covid pandemic, he publicly urged Donald Trump to shut down the US economy for 30 days, warning that otherwise: «America as we know it will be finished.»

Kenneth Griffin (net worth: $34.2 billion)

Florida-based Kenneth Griffin began investing while studying economics at Harvard and founded a hedge fund in his second year at university using $275,000 borrowed from friends and family. Success in hedge funds continued for twenty years, until he founded Citadel in 1990. Now it is one of the most successful financial institutions in the world, its assets are estimated at 62 billion dollars.

But recently, Griffin has become more popular in the gossip pages, in part due to a costly divorce from his wife, hedge fund manager Ann Diaz. Diaz accused Griffin of manipulating her into signing a prenuptial agreement hours before the wedding dinner rehearsal, and after breaking up, cut off her credit cards and banned her from their homes in New York, Aspen, Miami and Hawaii.

Citadel founder and billionaire Kenneth Griffin Photo: REUTERS/Phil McCarten

Citadel founder and billionaire Kenneth Griffin Photo: REUTERS/Phil McCarten

Diaz claimed she was entitled to well over one percent of Griffin's fortune, as stipulated in their prenuptial agreements, while demanding monthly maintenance, alimony, and sole custody of their three children. Fighting back, Griffin accused Diaz of being a flamboyant spender, shelling out a million dollars a month on purchases including groceries, stationery and meals. Of particular note was Diaz's ten-day holiday with the children in St. Barts, for which she demanded $450,000; instead, he agreed to pay $45,000 for skiing.

Responding even more, Diaz stated that her requests were a drop in the ocean compared to her husband's monthly earnings. She claimed Griffin was taking home $68.5 million a month after taxes, which works out to $2.2 million a day, or $92,000 an hour.

Luckily for both parties, they managed to work out a confidential agreement hours before their case went to trial. Griffin subsequently began spending his own money. The billionaire who donated millions to conservative causes, including Ron de Santis and the doomed political campaigns of Marco Rubio and Jeb Bush, has gone bankrupt on $300 million since his divorce.

The Waldorf Astoria in Chicago, two floors owned by Kenneth Griffin. Photo: Waldorf Astoria Chicago

The Waldorf Astoria in Chicago, two floors owned by Kenneth Griffin. Photo: Waldorf Astoria Chicago

He spent nearly $30 million to buy two whole floors of Chicago's Waldorf Astoria hotel, as well as $200 million to buy three floors of Manhattan's Central Park South building — real estate records for both cities. CNBC reported that, quite naturally, he did not intend to live in Central Park South, but bought the floors as an «investment». He also set the record for the most expensive home ever sold in America when he bought four floors of a New York skyscraper at 220 Central Park South for $238 million. The property came unfurnished, meaning that Akman had to «finish it». He is also a major art collector, owning several of the best-selling paintings ever, including works by Andy Warhol, Paul Cezanne and Jackson Pollock.

Other expenses included hiring Katy Perry and Maroon 5 to perform private concerts at Citadel events. Citadel faced scrutiny from the federal government for «misleading statements» about its deals, but their final fine was essentially pocket change: $22 million, or what Griffin earns for six days of work. It has also been at the center of the Gamestop controversy; Citadel sold shares in the retailer, and it was targeted by Robin Hood investors who saw an opportunity to get ahead of the masters of the universe. The Citadel lost hundreds of millions of dollars. In 2021, he testified before Congress about his role in the case.

Nelson Peltz (net worth: $1.5 billion)

Nelson Peltz made a fortune by acquiring and selling lackluster companies for profit, resulting in a portfolio that at one time or another included Wendy's, Heinz, Kraft Foods, Cadbury and Snapple. He runs an activist fund, Trian Partners, which manages $8.4 billion.

But his flamboyant excess caused a storm of discontent even from his elite neighbors. In the 1990s, neighboring residents of his 130-acre estate in Bedford, New York, including Michael Douglas, Glenn Close, and Martha Stewart, sued Peltz and his wife for regularly flying private helicopters to New York. York and back, creating noise pollution that disrupted their peaceful existence in Westchester County.

Billionaire Nelson Peltz junk bonds. Photo: Lisa Kyle/Bloomberg News

Billionaire Nelson Peltz junk bonds. Photo: Lisa Kyle/Bloomberg News

Peltz insisted the lawsuit was the result of snobbery about the source of his income: «DeWitt Wallace could fly around this property in a rocket ship and no one would complain,» he told The New York Times, referring to the previous owner. of his fortune, founder of Reader's Digest. «The difference is that he made money on Reader's Digest and I made money on junk bonds.»

The battle dragged on for five years, with Peltz ultimately losing. But the noise from the helicopter was nothing compared to the stories that have since surfaced about his family's mistreatment of their staff. A controversial report on the defunct Gawker, called «Nelson Peltz's House of Horror», claimed that the family was essentially living in their own Aaron Spelling soap opera.

The 130-acre Peltz family estate in Bedford, New York. Photo: Google Earth

The 130-acre Peltz family estate in Bedford, New York. Photo: Google Earth

In one case, it was even alleged that the butler was fired on Easter Sunday by Peltz's model wife Claudia after she found drops of urine on the toilet seat in their master bedroom. It wasn't until Mrs. Peltz allegedly made the butler clean the seat four times («One more time for good luck,» she reportedly said) that the butler was fired. A spokesman for the family told Gawker at the time that the allegations were «an outrageous fabrication.»

The family was also sued by their former driver for wrongful termination after he claimed he was fired shortly after being released from the hospital due to a head injury. In 2017, the family's bodyguard sued the Peltsov, alleging he was fired for his first sick leave in a year and a half after seeking medical attention for shortness of breath and a diabetes-related illness.

Actors, siblings Will and Nicola Peltz. Credit & Copyright: Matt Baron/BEI/Shutterstock

Actors, siblings Will and Nicola Peltz. Credit & Copyright: Matt Baron/BEI/Shutterstock

Peltz's two children are now making headway in Hollywood. Two-time Razzie nominated Nicola Peltz starred in Transformers: Age of Extinction, Bates Motel and Zayn Malik's music video; She married Brooklyn Beckham last year. However, their $3.5 million wedding has since become a source of controversy. Peltz sued one of the wedding planning firms involved in the wedding after they reportedly refused to return his deposit after they were fired nine days after planning. They have since filed a counterclaim for $49,000. The court case drew attention to convoluted planning details, including $11,000 spent by the bride on her makeup and catering plans rejected by Beckham, such as the «Brooklyn burger.» Peltz replied, «I don't like it [vomit emoticon].»

Her brother Will is also an actor who has starred in No Friends and Men, Women and Women. Children.

Larry Fink (net worth: $1 billion)

After Axelrod's departure in the sixth season, his firm Ax Capital is taken over by Michael Prince of Corey Stoll. Initially, the Prince presents himself as a small-town farm boy who got rich to give back to society, specifically by swaying Ax Capital towards environmental, social and governance (ESG) goals. But this homegrown hypocrisy is slowly exposed as a scam in the series, and he proves to be just as ruthless, corrupt, and profit-seeking as the rest of the Billions' ragtag team. commodity on Wall Street. And many titans of finance could possibly have been the inspiration for Stoll's character. But Larry Fink, CEO of BlackRock, the largest investment company in the world with $10 trillion under management, may have been top of mind for the writers.

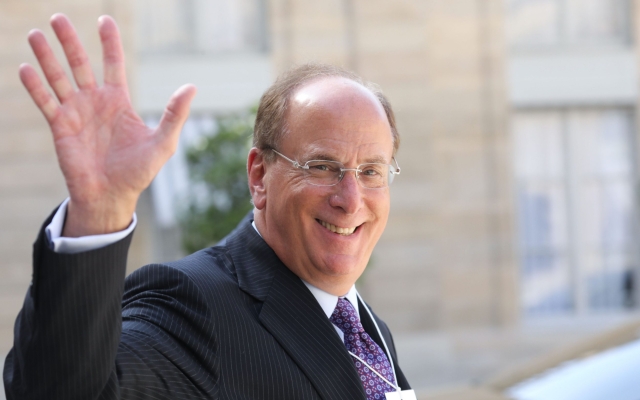

BlackRock CEO Larry Fink Photo: Ludovic MARIN/AFP

BlackRock CEO Larry Fink Photo: Ludovic MARIN/AFP

Fink founded BlackRock in 1988 and by 2016 the company had $5 trillion under management and over 27,000 employees. Fink placed ESG at the center of BlackRock's priorities in his 2018 annual letter to shareholders, arguing that the companies owe it to society. In 2022, he doubled that message by stating on climate: “Every company and every industry will be transformed by the transition to a zero-emissions world. The question is, will you lead or will you be led?”

Activists, however, note that BlackRock is less than enthusiastic about what it preaches. For example, BlackRock is the largest investor in the US military in the production of weapons. And while Fink pulled BlackRock out of the Saudi Arabia conference after the assassination of Jamal Khashoggi, they were soon quick to do business with the regime again. In 2021, they teamed up with a Saudi investment manager to buy and then lease $15.5 billion worth of gas pipelines from Saudi Aramco. BlackRock has also been named the largest investor in deforestation companies, making Fink a notorious figure among environmentalists.

Daniel Loeb (net worth: $3.5 billion)

Self-made billionaire Daniel Loeb made his fortune buying struggling companies, firing and replacing their inefficient management, and returning profits to them. A passionate art lover, Loeb has spent millions on his collection of works by Basquiat, Cindy Sherman, Andy Warhol and Jeff Koons that decorate the walls of his offices and homes. He proudly stated that his love of art stemmed from his student years, when his humble past humiliated his peers.

«I have enjoyed art ever since I entered Columbia,» he said. during a speech by the Jewish Enrichment Center. “I went to the Met and saw Poussin's The Rape of the Sabines and it's incredible, epic, great, great picture.

“I went to Columbia University and luckily they had a core curriculum — I had a liberal arts class on art. I raised my hand [to identify the painting]: «This is Poussin.» All the prep school students said, «What an asshole.» school snotty kids don't.»

Hedge fund manager Daniel Loeb Photo: REUTERS/Andrew Kelly

Hedge fund manager Daniel Loeb Photo: REUTERS/Andrew Kelly

But Loeb's outspoken nature sometimes got him into trouble. When Loeb wrote an open letter in 2013 suggesting that Sony Entertainment split up its film and video game divisions after a summer of box office failures, he drew the ire of none other than George Clooney.

“The Hedge Guy the foundation is the only least qualified person to make that kind of judgment,» Clooney told Deadline. “He is dangerous for our industry. Hedge fund guys don't create jobs, but we [in the film industry] do.»

Loeb also had a run-in with Ekman's rival, billionaire Carl Icahn, who outbid him for a luxurious penthouse located in the outrageously expensive Fifteen Central Park West building. While Icahn was trying to bargain with the building's developers, Ackman offered a price of $45 million. Icahn was reportedly furious.

An apartment in an expensive Fifteen Central Park West building that Loeb bought for $45 million in 2008. Credit: Archinect

An apartment in an expensive Fifteen Central Park West building that Loeb bought for $45 million in 2008. Credit: Archinect

«Fuck it, fuck it.» He said “fuck it” five or six times in thirty seconds and then hung up,” said developer Will Zeckendorf. “Dan was there early. He was a terrific customer.»

In recent years, despite having poured millions into LGBT support organizations and Barack Obama's 2008 presidential campaign (they were classmates at Columbia University), Loeb has dabbled in conservatism, when it comes to his company pockets. Immediately after Brexit, Loeb invested his hedge fund company Third Point, which owns more than $6 billion in assets, into US stocks when its shares fell, but then made a profit when shares bounced back later that month. He also praised Donald Trump's pledge to cut corporate taxes, government regulations, and taxes on high-income individuals.

Interestingly, Loeb comes from the royal family of fat cats: his grandparent, Ruth Handler, founded the toy company Mattel and co-created barbie doll. However, his thoughts on the recent film remain unknown.

Season 7 of 'Billions' now airing on Sky Atlantic (UK) and Showtime (US)

Свежие комментарии