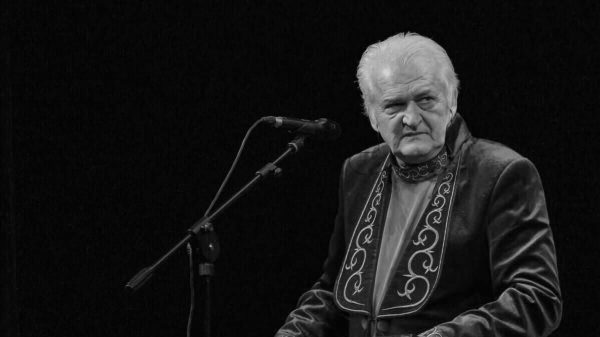

Mr Quinn said the current pace of global borrowing was unsustainable. Photo: Holly Adams/Bloomberg

Mr Quinn said the current pace of global borrowing was unsustainable. Photo: Holly Adams/Bloomberg

The world is at a “tipping point.” HSBC's chief executive warned of debt that threatens to trigger a global reckoning after years of government borrowing.

Noel Quinn, chief executive of the bank, one of the world's largest, said countries risked taking a «big hit» after how borrowing was allowed to surge as a result of the financial crisis and pandemic.

Speaking at the Institute for Future Investment Initiatives summit in Saudi Arabia, known as Davos in the desert, Mr Quinn said current borrowing levels were unsustainable.

He said: “I am concerned about the tipping point of the budget deficit. When it happens, it will happen quickly, and I think there could be a tipping point in a number of economies around the world, and it will hit hard.»

Mr. Quinn's comments came as a number of leading Wall Street bankers warned about the state of the global economy as the war between Hamas terrorists and Israel threatens to spread into the Middle East. < /p>

Larry Fink, chairman and Blackrock chief executive, suggested rising tensions threaten to plunge the world into recession.

Speaking at the same event, he said: «There's no doubt that if these issues aren't resolved, it probably means more global terrorism, which means more instability, which means the public will be scared, [and] we'll see a decline in our economy.

The International Monetary Fund and the World Bank expressed alarm over global debt levels earlier this month, warning that the United States and China have put government debt on a course that will approach the size of the entire global economy by the end. decades.

Ayhan Kose, deputy chief economist at the World Bank, described the debt binge since 2010 as “the fastest, most extensive and far-reaching” the world has ever seen. All previous waves of debt led to financial crises.

Mr Kose warned that emerging markets were already in the middle of a “silent debt crisis”, with governments crushed by debt and unable to finance public services.

Mr Quinn also described Europe as a «very low growth economy», adding that countries including the UK were likely to see higher interest rates to curb inflation.

“The real problem for Europe is the short term. and likely medium-term growth,” he said. “[Europe] will bring inflation under control, although there is a possibility of a second wave as wage inflation is still not under control in Europe and especially in the UK. I think we're all seeing evidence of that in our economies now.»

Jamie Dimon, chairman and chief executive of Wall Street giant JP Morgan, called for «some humility in financial forecasting.»

p>

“I want to point out that 18 months ago the central banks were completely 100 percent wrong.” — he said at an event in Riyadh.

It came as economists warned France and Germany were dragging the eurozone into recession after a closely watched survey showed business activity contracted more sharply than expected.

Europe's biggest economies in October There was a sharp decline in new orders in manufacturing and services, with German service companies reporting their worst sales in nearly three-and-a-half years and France experiencing its sharpest fall in industrial production since May 2020.

The slump has led to a broader fall in private sector output across the bloc, forcing companies to cut jobs.

Flash Purchasing Managers' Index In the eurozone, S&P Global's PMI fell to a 35-month low of 46.5, representing the biggest fall in output in a decade excluding the pandemic.

The fall means activity in the single currency bloc is well below the 50 level that separates growth from contraction, and below the 47.4 reading expected by economists.

An influential study of British business also found that private sector activity fell. for the third month in a row in October.

Cyrus de la Rubia, chief economist at the Hamburg Commercial Bank, which helps compile the index, warned that the eurozone economy was “going from bad to worse.”

Giada Jani, the Citi economist, said polls were already pointing to a 0.3% contraction in the eurozone economy in the three months to September.

She said: “Further decline October now suggests a similar, if not deeper, contraction in the fourth quarter. This is consistent with our forecast of a recession in the eurozone, which is likely to have already begun and will continue… into early 2024.

Ms Jani added that higher borrowing levels and a weaker labor market suggest that interest rates in the single currency area peaked at 4%.

Свежие комментарии