Joe Biden's planned visit to Jordan aimed at easing tensions has been canceled as regional diplomacy continues to deteriorate. Photo: MIRIAM ULSTER/POOL/AFP via Getty Images

Joe Biden's planned visit to Jordan aimed at easing tensions has been canceled as regional diplomacy continues to deteriorate. Photo: MIRIAM ULSTER/POOL/AFP via Getty Images

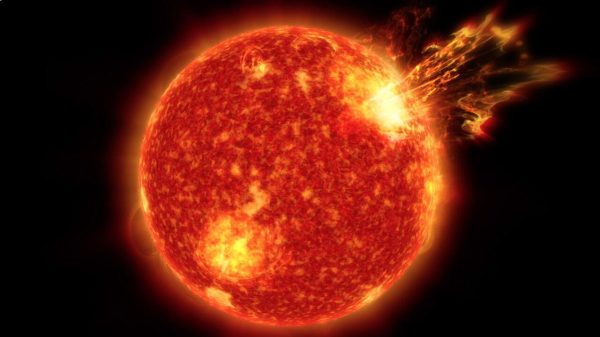

A deadly explosion at a hospital in the Gaza Strip sent oil prices to their highest level since the war between Israel and Hamas began on Wednesday.

The explosion derailed US diplomatic efforts in the region led by Joe Biden and raised fresh fears of supply disruptions.

Brent crude rose 3.5% to $93. barrel, while concerns about wider conflict in the Middle East have increased.

Prices fell after US intelligence suggested Gaza terrorists were responsible, although a peace summit with the leaders of Jordan, Egypt and the Palestinian Authority was canceled even after the US president met with Israeli leader Benjamin Netanyahu.

Oil prices have already risen by more than a quarter since mid-June amid supply cuts by Saudi Arabia and Russia.

However, investors became increasingly nervous after Iran's foreign minister called for an oil embargo against Israel.

Hossein Amir-Abdollahian said earlier this week that an escalation of the war is «inevitable.»

The Middle East accounts for more than a third of the world's seaborne oil trade, the international Energy Agency said last week that markets are likely to remain on tenterhooks as the crisis unfolds.

Amrita Sen, director of Energy Aspects, which advises more than 500 companies around the world, warns that prices could suddenly rise if the conflict widens.

She says: “If the conflict escalates and has an impact on Iranian supplies, price the action becomes very binary. So either we will remain at $93 per barrel, or we will easily rise to $120–140.

“Iran is a major oil producer. It exports about 1.8 million barrels per day and produces more than three million barrels per day. It is a major supplier of oil to the market. Even though the country is under sanctions, it still manages to sell about 1.8 million barrels a day to China.”

Gold prices also jumped as demand for safe haven assets soared. The price of the precious metal rose as much as 1 percent to $1,943 an ounce on Wednesday and has soared as much as 7.6 percent since the first Hamas attack.

Jonas Goltermann of Capital Economics says this is a clear sign that investors are nervous.

He says, «There's no really good reason to buy gold unless you're worried about really bad results.» «.

Concerns about persistent inflation also rocked bond markets, sending the yield on the benchmark 10-year U.S. Treasury note to a 16-year high on bets that interest rates in the world's largest economy will remain high for a long time.

Fears of persistent inflation also rocked bond markets, sending the yield on the benchmark 10-year U.S. Treasury note to a 16-year high on bets that interest rates in the world's largest economy will remain high for a long time.< /iframe>

p>

The potential for an escalation war between Israel and Hamas is “enormous,” says international security expert Nomi Bar-Yaakov, who is an associate fellow at Chatham House and has held numerous UN posts.

“The more civilian casualties there are in Gaza, the more Arab public opinion will feel that their governments are not doing enough,” she says.

“I think there will be a lot of street violence and governments will be under pressure, and then you will have individual, very, very wealthy donors from different Gulf countries pouring money into those who are ready to attack Israel.”

Some are comparing the unfolding conflict to the Syrian and Egyptian attack on Israel almost exactly 50 years ago, which became known as the Yom Kippur War.

The Arab states then responded to America's support for Israel by cutting off oil supplies. countries that supported him, including Great Britain.

The embargo has cut oil supplies by 14% worldwide and caused U.S. gasoline prices to rise by as much as 40%. Prices soared as consumers around the world panicked over oil shortages.

The episode led to President Nixon announcing a new energy policy and the goal of US energy independence.

Since then, the fracking boom has boosted U.S. production by millions of barrels per day, reversing nearly three years of decline and allowing the U.S. to become a net oil exporter in 2020 for the first time since 1949.

Ayhan Kose, deputy chief economist at the World Bank, says this is one reason why the world is a very different place than it was in 1973.

“The nature of economies’ dependence on oil varies,” says Kose. “There is a much larger set of suppliers and a much larger set of alternatives.

“Compared to the 1970s, this is a different kind of shock. It really was an extraordinary response — an embargo and very high prices.»

But in other respects the world is in a much more dangerous situation, says Kose. Since 2020, policymakers have faced a series of economic shocks that began with the pandemic.

Russia's invasion of Ukraine triggered a wave of inflation that policymakers are still grappling with after delaying interest rate hikes.

The International Monetary Fund warned last week that conflict in the Middle East represented “a new cloud gathering” over the global economy. economy.

The company estimates that a 10% rise in oil prices would raise global inflation by about 0.4 percentage points a year later.

Capital Economics previously estimated that if global oil prices rose to $150 a barrel , inflation will be one percentage point higher in 2024.

The risk of a third wave of inflation would be unwelcome at a time when every central bank in the G7 faces inflation above its 2 percent target.

“Given that inflation has already been above target for the past two years, a new surge in inflation could well lead to expectations becoming unsupported,” said Henry Allen and Cassidy Ainsworth-Grace of Deutsche Bank.

Many countries have been left mired in debt following Covid lockdowns, leaving them with fewer financial resources. firepower to combat new economic shocks.

Global cooperation on issues from trade to security is also eroding.

Last week, a G7 communiqué from the rich country group of finance ministers and central bank governors was delayed by an hour after Japan raised concerns about language used in the joint statement.

>Leaders of the larger G20 group made no mention at all war between Israel and Hamas.

Kose says this has left the world economy in a precarious position. “The way we think about it is this shock comes against a backdrop of weak global growth and a lot of shocks. And that's a concern.

“Look at what happened in the US bond markets. The world economy is moving to a new regime. Before 2020, we had lower interest rates and [even] negative rates, higher growth, less debt and lower interest payments.

“Now it's the other way around. It's a toxic combination of weak economic growth, high debt and high interest rates, and it could mean we're about to see a crash on the road.»

Свежие комментарии