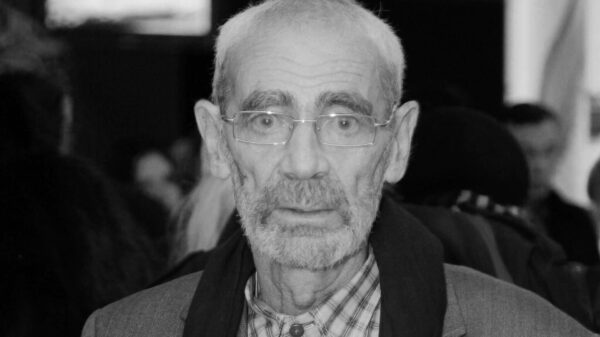

Ms Georgieva warned that economic and financial turmoil was becoming the “new normal”. Photo: Fadel Senna/AFP

Ms Georgieva warned that economic and financial turmoil was becoming the “new normal”. Photo: Fadel Senna/AFP

The head of the International Monetary Fund has warned that the conflict in the Middle East, sparked by the Hamas terrorist attack in Israel, is a “new cloud gathering” over the global economy.

Kristalina Georgieva said, that officials are closely monitoring developments in the region amid an escalating conflict that has led to rising oil prices and turmoil in financial markets.

It comes as the economy is already struggling, as official data on Thursday showed Britain posted 0.2% growth in August, raising fears of a recession. In addition, higher US fuel prices put more pressure on inflation.

The IMF managing director said economies around the world have already faced a series of shocks since 2020, including the pandemic and rising prices caused by the war in Ukraine.

This week the Fund cut its forecast for global growth. and warned that the recovery is “faltering” amid the threat of a new war in the Middle East.

“It is clear that this is a new cloud on the not-so-sunny horizon for the global economy. There is a new cloud clouding this horizon, which is, of course, unnecessary,” Ms. Georgieva said at a press conference at the IMF’s annual meeting in Morocco.

While she added that it was «too early» to determine the impact on the global economy, she warned that economic and financial turmoil was becoming the «new normal» as governments run out of fiscal space to deal with crises.

She also warned that higher interest rates over longer maturities could trigger further market instability as a “sharp further tightening of financial conditions” hits markets and non-banks.

Ms Georgieva said fund officials were now being forced to «think the unthinkable» in terms of preparing for future shocks and their role as lender of last resort.

She said: «We are in the midst of serious turmoil.» it is now becoming the new normal in a world weakened by weak growth and economic fragmentation.”

The IMF chief also warned that central banks will have to keep interest rates high for longer to contain the situation. inflation, which further constrains growth.

Ms Georgieva said: “In many countries, inflation has fallen but is still above target. So interest rates will have to remain high for longer, further chilling already anemic economic growth.»

Higher UK interest rates are slowing economic growth, with economists warning of growing risks recession.< /p>

GDP rose 0.2% in August, an improvement from a 0.6% fall in July, but growth remains weak.

The Office for National Statistics said industrial output in August fell 0.8% and construction fell 0.5%, but the services sector, which dominates the economy, returned to growth, with output increasing 0.4%.

Overall the decline was 0.2%. The percentage increase in GDP represents a partial recovery from a 0.6% fall in GDP in July, when strikes, including among teachers and doctors, hit economic growth hard.

Swati Dhingra, member of the Monetary Committee The Bank of England's lending policy committee said the economy had «already stabilized.»

«When you're growing as slowly as we are now, the chances of a recession or no recession are about equally balanced,» she told the BBC. “So we have to be prepared for this.”

Investec's Sandra Horsfield said the economy was likely to fall into a shallow recession this winter, with the economy either contracting or remaining flat in the third quarter. She said: “The Bank of England is likely to take this as a sign that the tough medicine of very rapid rate hikes is starting to take effect — with no hint of a deep recession yet.”

p>In the US, inflation remained stable at 3.7%, rather than falling as economists had expected, with higher fuel costs continuing to weigh on households.

Bond yields rose on concerns that inflation will persist means the Federal Reserve will have to keep interest rates high for longer.

Meanwhile, Hugh Pill, chief economist at the Bank of England, said companies are shifting away from hiring in favor of increasing pay for existing employees, suggesting potential new inflationary inflation. labor market pressures.

He told a group of experts in Marrakech: “Given the difficulties in recruiting, we are increasingly seeing labor hoarding behavior and perhaps the re-emergence of the insider-outsider dynamic.” in setting wages.

“We certainly see a big discrepancy between what surveys tell us about new hires, how much they are paid, and what surveys tell us they are paid, and what they are paid . And such a discrepancy may indicate that the labor market may behave differently.»

Свежие комментарии