Jeremy Hunt was accused of forgetting about pensioners in his budget, cutting taxes for workers but failing to please pensioners.

Paul Johnson of the Institute for Fiscal Studies said pensioners were «significant losers» from the announcement, while former employment minister Anne Widdecombe said it was «unbelievable» that the government could forget about a gray election in an election year.

“They just decided to pretend we don’t exist,” she fumed.

In fact, the pensioners lived under the leadership of the Conservatives and the coalition for a good 14 years. While they didn't have much in the last Budget, many others did.

The Triple Lock, introduced by George Osborne in 2010, saw state pensions rise significantly compared to average household earnings. workers, for example, this month the increase was 8.5%.

Services on which pensioners disproportionately rely, such as the NHS, have repeatedly received significant budget increases.

Income tax is rising. The threshold in the early years of Tory and Lib Dem governments was also a boon.

As well as government support, today's retirees have benefited from soaring property values as they climbed the corporate ladder, generous final salary pension schemes pay and improve both the duration and quality of life.

Today's retirees are in Johnson's hands. in other words, the “lucky” generation.

It wasn’t just the triple lock on the state pension that benefited them financially. Occupational pensions were also better for many of today's retirees, allowing them to accumulate a generous final salary.

These schemes guarantee pensioners a certain level of income in retirement, comparable to their last salary, sometimes linked to inflation.

Almost half — 46% — of all workers who were saving for retirement in 1997, they included this is included in the final salary scheme.

Today, barely one in five workers has a final salary plan. Instead, most invest in riskier defined contribution schemes, which are simply a lump sum that is invested.

If employees save a minimum of 8 percent of their salary, of which 3 percent comes from the employer, they will face a sharp fall in their income when they retire.

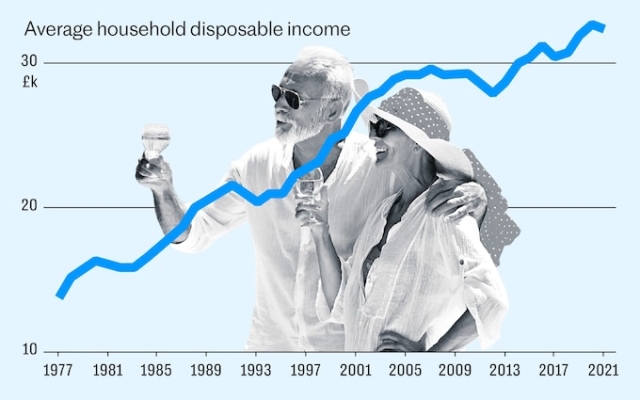

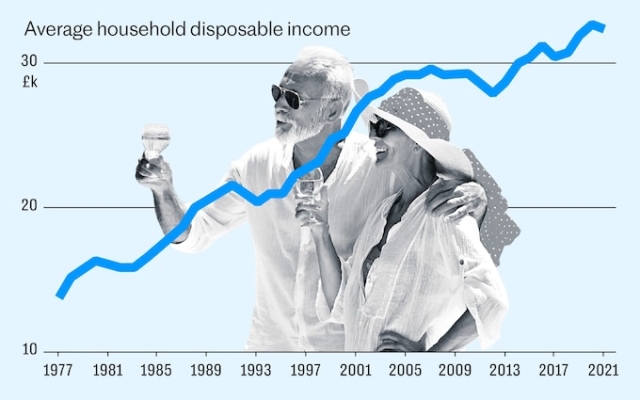

Generous private pensions and the triple lock have helped increase pensioner household incomes by more than 40% in real terms over the past 20 years.

For those who are younger than retirement age and primarily work, the increase was only 19%.

This gives retirees some insulation from the cost of living crisis and higher interest rates. Only one in 10 people over 75 are “not coping” with financial problems, according to a household survey published by the Financial Conduct Authority on Wednesday. Four times more people aged 35 to 44 experience difficulties.

People aged over state pension age now have, on average, virtually the same amount of disposable income as workers, according to the IFS's Johnson.

This partly reflects the improvement in the financial situation of retirees. But it is also the result of stagnant wages for workers. The Resolution Foundation estimates that the decline in real wages has cost today's workers around £11,000.

Pensioners are lucky not only financially. Over time, the world has become a better place in many areas, from the prices and variety of food offered to technological advances and the successful treatment of more diseases.

The typical family now has more than twice as much available money to spend on items of their choice than 45 years ago.

Food has become cheaper: The amount the average family spends on food and drink has halved since the mid-1980s.

< p>While these improvements have benefited everyone, they are benefits that past generations of retirees have not benefited from. In this sense, this cohort was lucky.

Rising life expectancy means retirees can also expect many more years in retirement than their parents' generation.

In 1984, a 65-year-old man could expect to live just over 13 more years. Now a man of the same age is likely to live another 19 years, an improvement of almost six years.

The rate of this growth is slowing. In 40 years' time, in 2064, a 65-year-old man is expected to live 22.3 years — 3.3 years more than today. The state's retirement age is also increasing, so part of the extra life will be spent working.

In other countries, there are signs that future retirees will not be as lucky as the current group.

Housing costs are a rare example of the situation clearly getting worse, meaning today's retirees are significantly luckier than today's youth. .

In 1980, the average house cost less than £23,000, according to Nationwide. By 2000 this figure had risen to over £77,000. This is now over £260,000.

Wages are not keeping pace with rising housing prices. According to UK Finance, in 1980 the average first-time buyer took out a mortgage worth twice their income. By 2022, the typical home buyer was borrowing more than three times their income.

Those who bought a home in the 1980s or 1990s have benefited enormously from these price increases, although mostly in paper terms if they own one property.

Meanwhile, younger buyers faced difficulties.

Rising prices have also forced today's young people to save money for a deposit longer. Buyers now typically take out mortgages over 30 years to spread out the cost of debt, rather than the traditional 25 years.

Housing prices are not the only factor. Interest rates also matter. The Bank of England base rate rose to double digits for large periods in the 1970s, 1980s and early 1990s, which meant that mortgage repayments were large even if affordability ratios were better.

However, interest rates have never been this high. above 6% over the last quarter century, which limits the pain somewhat.

This does not mean that it has always been easy for today's retirees, or that things are necessarily especially difficult for young people.

Unemployment, for example, is extremely low by historical standards. For most of the last five years, the figure has been close to 4%, except for a brief spike during the lockdown. The rate hasn't been this low since the mid-1970s.

In contrast, during the recession experienced by today's retirees in the 1980s and 1990s, unemployment peaked at more than 10%.

Retirees have not always enjoyed the standard of living and prosperity they enjoy today, and they have had to work hard to achieve this.

And yet here, once again, retirees have the wind at their backs. Overall purchasing power increased at an average rate of 2.7% per year for three decades until 2007, when today's retirees were working.

Growth has largely stalled since then, rising at just 0.7% per year. . As a result, today's workers struggle to see the same evidence of progress in their lives as retirees saw while they were working.

Meanwhile, with education disrupted by Covid, there is a mental health crisis among young people and people With the economy stagnating, future generations of workers could be worse off.

While the IFS's Johnson called the current crop of retirees a «lucky one,» he warned last year that «for those entering work in over the next couple of years… I'm afraid they will become a truly unlucky generation.»

Свежие комментарии