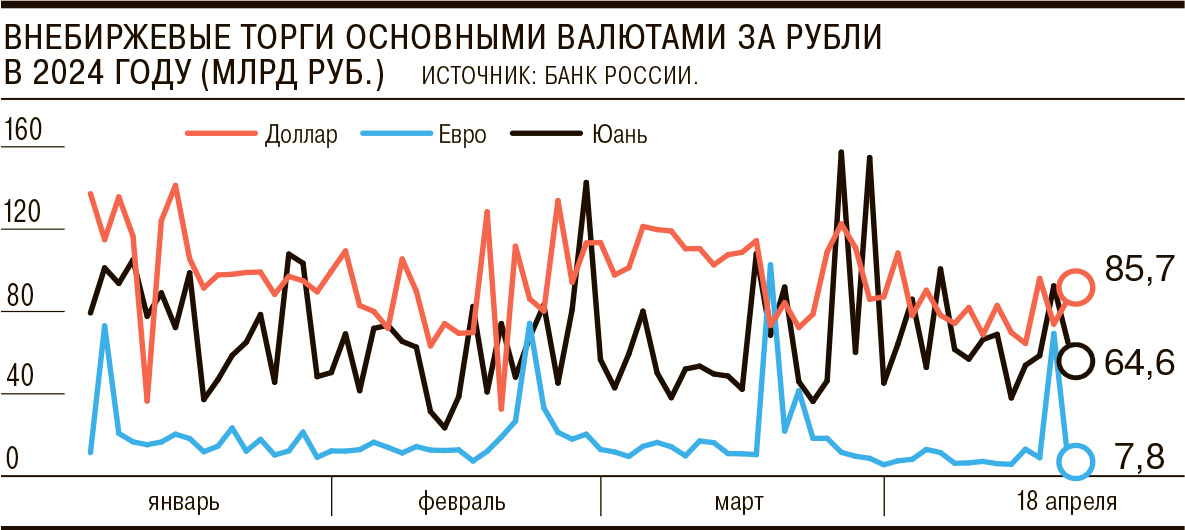

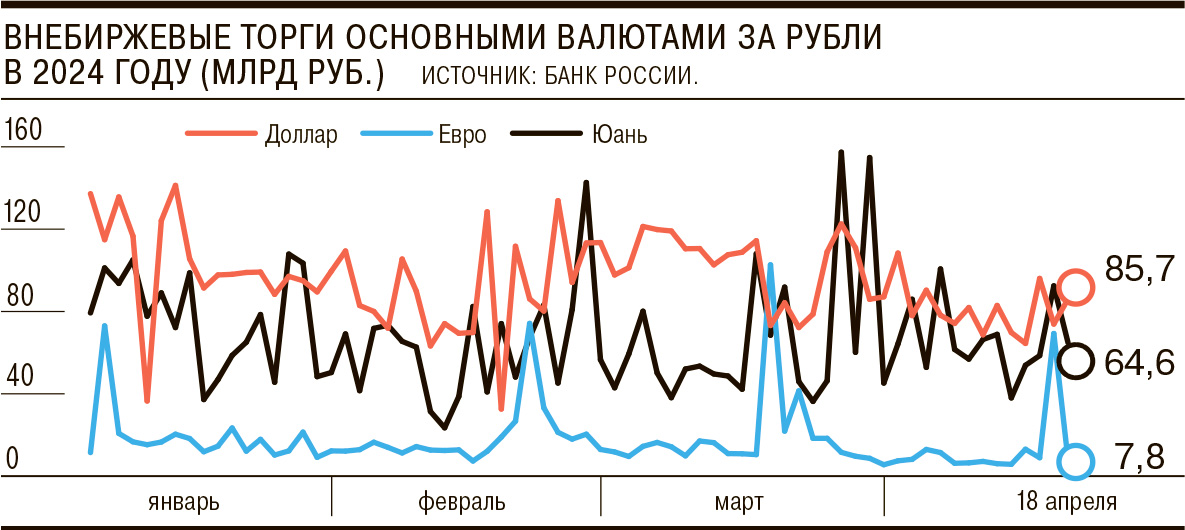

Under the conditions of ever-expanding sanctions, over-the-counter currency trading is actively growing, according to data from the Bank of Russia. The total trading volume in major currencies (dollar, euro, yuan) has amounted to RUB 12.5 trillion since the beginning of the year, which is almost double the figure for the same period in 2023. Moreover, on the over-the-counter market, the volume of yuan trading, although it has more than tripled, to 4.7 trillion rubles, is still inferior to the dollar (6.6 trillion rubles). Market participants talk about the risks of secondary sanctions, due to which there is a flow of liquidity to the less transparent over-the-counter market.

The Bank of Russia began to publish data on a daily basis on over-the-counter trading turnover in the dollar, euro and yuan against the ruble with settlements “tomorrow”. The regulator presented not only current values, but also historical ones starting from October 2022. According to them, the total volume of currency trading from the beginning of the year to April 17 amounted to 12.5 trillion rubles, which is almost double the figure for the same period in 2023, but one and a half times lower than the figure for exchange trading in a similar settlement mode (18.8 trillion rubles. ).

Yuan trading volume grew the fastest. Since the beginning of the year, the total trading volume in this currency amounted to almost 4.7 trillion rubles, which is 3.35 times higher than the result of the same period in 2023. But unlike the exchange market, where the yuan supplanted the US dollar from the leading position already in the middle of last year, in the over-the-counter market it ranks only second with a share of 37.5%. Over the year, the renminbi's influence grew by 17.2 percentage points (pp). At the same time, the share of the dollar decreased over the year by 2.82 percentage points, to 52.6% (RUB 6.6 trillion) of the market, but retains first place. The share of euro trading decreased by almost 2.5 times, to less than 10% (RUB 1.2 trillion).

The anomaly that has developed in the market is associated with a sharp increase in trading volumes between non-credit organizations, the volume of dollar trading between them since the beginning of the year amounted to 4.8 trillion rubles, an increase of 2.5 times compared to last year.

At the same time, the trading volume of credit institutions decreased by 13%, to RUB 1.7 trillion. At the same time, banks increased the activity of over-the-counter transactions with the yuan almost sevenfold, to RUB 2.8 trillion. At the same time, trading activity between non-credit organizations remained at last year’s levels (RUB 1.8 trillion).

Under the influence of Western sanctions, large Russian banks were forced to abandon “toxic” currencies in favor of more friendly ones — primarily the yuan. “Foreign banking organizations are also under the supervision of Western regulators and risk being subject to sanctions for trading with Russia,” notes Sovcombank chief analyst Mikhail Vasiliev. The risks of secondary sanctions increased sharply after the US President signed a decree on December 22, which gave the US Treasury the authority to punish foreign banks that violate sanctions against the Russian Federation.

In such conditions, according to Mikhail Vasiliev , Russian companies and foreign trading partners are forced to build a chain of intermediaries in order to reduce sanctions risks. And also move to the over-the-counter market.

“The main players in this market are non-financial companies that pay for Russian exports, and most contracts are concluded in unfriendly currencies,” notes Dmitry Lesnov, head of the client service development department of Finam Financial Group. “Western companies rather prefer transactions denominated in dollars and other hard currencies. Hence the increased demand from companies from the non-financial sector for dollars and euros,” notes Vladimir Evstifeev, head of the analytical department of Zenit Bank.

Nevertheless, according to Dmitry Lesnov, Russian exporters will gradually try to convert exports into the currencies of friendly countries. Next, the role of currencies of friendly countries will grow, primarily the yuan, as well as the UAE dirham and, possibly, the Indian rupee. But analysts do not expect a complete transition to these currencies in foreign trade in the coming years. “The use of “toxic” currencies in foreign trade transactions is more convenient. The rapid transition to the yuan in the Russian Federation is hampered by the still weak development of the yuan market outside China,” concludes Mikhail Vasiliev.

Свежие комментарии