Xavier Rolet headed the London Stock Exchange from 2009 to 2017. Credit: LEON NEAL/AFP

Xavier Rolet headed the London Stock Exchange from 2009 to 2017. Credit: LEON NEAL/AFP

The former head of the London Stock Exchange (LSE) has warned that minor reforms aimed at making the market more competitive will not save Square Mile from permanent decline.

Xavier Rolet, who has led the LSE since 2009 to 2017, said the government and regulators' efforts to make London a more competitive financial center were «an afterthought» and «a waste of time.»

Speaking to The Telegraph, the Frenchman warned that the only way to stem the City's decline was to cut taxes and cut red tape through a complete «recalibration of the UK's punitive fiscal and regulatory framework.»

The intervention comes amid fears that the City of London is losing its position as the world's leading financial center.

In recent months, a number of companies have decided to list in the US, including building materials company CRH and gambling giant Flutter. British tech leader Arm also said it would ditch City in favor of a New York listing.

Arm's decision was seen as a special blow to the government after intense lobbying and added to growing concerns about competitiveness.

Paris also solidified its lead over London as Europe's largest stock market in March, fueling fears that the London Stock Exchange is losing its appeal.

Mr Rolet, who is currently non-executive chairman of city broker Shore Capital, said the current regime is forcing fast-growing companies to flee to rival financial centers.

He said London will never compete with New York unless long-term investors such as pension funds and insurance companies increase their risks dramatically. to the stock market.

He said, “We need a recalibration. We must reduce the UK share taxation four times.

“We currently have a tax on dividends, a capital gains tax, income tax and a tax on transactions through stamp duty, which is the highest rate in the UK in all of Europe. The same pound of stock income is taxed four times.

“On the other hand, you have a regulatory framework that forces long-term investors, namely pension funds and insurance companies, to effectively short the real economy by preventing them from investing in the stock market.”

2304 UK production lags behind

Jeremy Hunt, Chancellor, laid out a series of proposals last December to strengthen the city's position, known as the Edinburgh Reforms.

They include loosening the rules on protecting small banks, obliging financial regulators to focus on stimulating economic growth. the rise and fall of rules holding bankers personally liable for breaking the rules in their presence. The package was intended to encourage risk-taking in the city to boost growth.

The Financial Conduct Authority (FCA) has also promised in recent weeks to make it easier for companies to list shares on the London Stock Exchange. The changes include moving away from premium and standard listing classes in favor of a single segment with less burdensome rules.

However, Mr Rolet fears that these measures will not have a significant impact on the UK's position in the international financial landscape.

He said London will continue to struggle when it comes to competing with New York and building multi-billion dollar tech companies.

He said: “There is no problem with start-ups in the UK. There are many good start-ups in the UK. But what the UK doesn't have, what Europe doesn't have, is stock markets to scale these startups and keep them.

“For this to happen, a recalibration of the fiscal environment is a requirement. If you don't, don't waste your time on sideshows and minor rule changes that I don't think will really change anything.»

1603 Business Investment Falling

He added that the UK had all the ingredients setting up £100bn technology companies, beyond the capital market, to expand and sustain these businesses.

Mr Rolet said: “If the UK wants to take full advantage of its fantastic universities and opportunities for science and innovation, all of which are no doubt part of the UK’s strengths, the only way to change that, and mark my words, is to unleash power.” its stock markets.

«The rest will just be on the edge… and won't budge.»

Mr Rolet also said that Brexit gives the UK an opportunity to cut the «red tape» European regulation, which, in his opinion, is «deeply unfavorable for stock markets.»

He said: “If you want the UK to use Brexit as an opportunity to close the productivity gap, generate significant capital growth and take full advantage of its fantastic universities and opportunities for science and innovation, the only way to do that is to unleash the power of its stock markets.”

One of Mr Role's legacies at the LSE was the acquisition of a majority stake in the clearing giant LCH. Clearing houses act as intermediaries in derivatives transactions between banks and have become a vital part of the financial system since the 2008 financial crisis.

However, the industry has become a key Brexit battleground as Brussels seeks to build «strategic autonomy» to develop its own capital markets.

Mr Rolet fears that the €660 trillion (563 trillion pounds sterling) is under threat due to Brussels' plans to ban its banks from clearing operations through London.< /p>

Mairead McGuinness, the European Commissioner for Financial Services, has given EU banks and money managers until June 2025 to shift settlement from London to the EU.

She vowed to punish banks on the continent for refusing to move the lucrative clearing business into in the City of London after Brexit.

She raised her eyebrows last year when she said the EU's reliance on the Square Mile was a vulnerability similar to its reliance on Russian oil and gas.

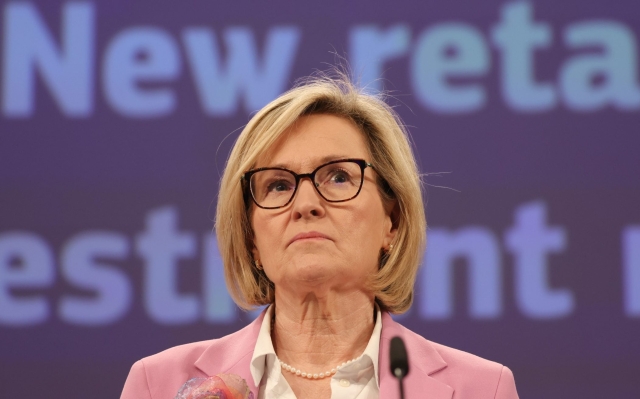

p> European Financial Services Commissioner Mairead McGuinness compared the EU's reliance on the city to its reliance on Russian gas. Photo: OLIVIER HOSLET/Shutterstock

European Financial Services Commissioner Mairead McGuinness compared the EU's reliance on the city to its reliance on Russian gas. Photo: OLIVIER HOSLET/Shutterstock

Mr Rolet warned that Brussels' onshore clearing plan posed a «systemic risk» to the European Union.

He said: “Europeans see Brexit as a political decision, so their response is clearly political. They don't understand why people put economic arguments [in the first place],» adding that the Commission «understands very little» clearing and sees Brexit as an opportunity to «grab it.»

«If the EU forces banks to flat in the EU and asset management to clear their euro-denominated interest rate swaps within the eurozone… if it happens over time because they can’t just force it to do it overnight, it’s a systemic risk they can’t afford.”

He added that the policy would likely force London to act in the US, where the EU has an equivalence agreement that includes clearing.

“This will not happen in six months. But if the engine moves, it will move to the US… the LCH clearing machine is in danger.

“To me, the litmus test for London is the ability to maintain its global financial crown. services — whether he will maintain a global clearing facility in interest rate swaps in the coming years.”

Last year, Role left the Russian chemical company PhosAgro after Vladimir Putin’s invasion of Ukraine.

He said: “I was on the board of directors of a Russian company, the EU published sanctions, and so I quit the same day. That's it.

“I've done IPOs in China and Russia with several British Prime Ministers and I was proud to bring some of them to the London market. But I don't do geopolitics, and when the environment changes, you have to change with it.»

Andrew Griffith, City Minister, said: «We have a track record of attracting the brightest and best companies in the world to rely on the UK's long-standing competitive advantage and attractiveness as a place to do business.

«But we're not resting on our laurels, which is why our Edinburgh reforms are so important and why we're committed to getting them in place quickly.< /p>

“From changing the culture of financial regulators, streamlining the time and processes required for listing, to improving investment research and more, the reforms represent an ambitious and comprehensive regime.”

Свежие комментарии