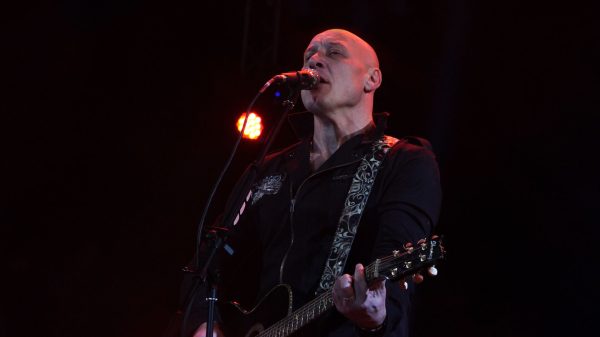

Mr Broadbent and five other MPC members recently voted to keep the interest rate at 5.25% Photo: Kirsty O' Connor/REUTERS

Mr Broadbent and five other MPC members recently voted to keep the interest rate at 5.25% Photo: Kirsty O' Connor/REUTERS

Wage growth is not yet falling fast enough, the Deputy Governor of the Bank of England warned, hinting that it was too early to consider cutting interest rates.

In a speech on Monday, Ben Broadbent said a «longer and more pronounced reduction» in wage increases is «likely to be required before the Monetary Policy Committee (MPC) can confidently conclude that the situation is on a sustainable trend to decline.»

He also warned that the conflicting data was also causing problems for policymakers on Threadneedle Street, particularly when assessing the UK labor market.

Mr Broadbent said the rise wages have grown «significantly faster than rates that in recent years can be considered consistent with the 2% inflation target.»

So far, annual wage growth — excluding bonuses — has slowed from a peak of 7.9% in the summer to 7.3% in the previous three years. months to October.

This has meant that inflation across the UK remains stubbornly high, even though the Bank raised interest rates to 5.25%.

Currently Since then, price growth has slowed from a peak of 11.1% in October 2022 to 4.6% a year later, still more than double the Bank's target.

The result is a warning that wages are not rising but the rapid fall is a sign that the Bank is not yet ready to cut interest rates.

At a policy meeting last week, Mr Broadbent and five other MPC members , consisting of nine people, voted to maintain interest rates. The other three members called for an increase to 5.5%.

This contrasts with the Federal Reserve, which has said it could soon begin reducing borrowing costs as inflation falls.

But while the Fed, led by Chairman Jerome Powell, believes pressure is easing enough to keep living costs under control, Mr Broadbent is less confident about Britain.

This is partly due to incomplete data on the state of the economy.

Mr Broadbent said labor market indicators provided by the Office for National Statistics were «quite volatile», particularly when tracking average weekly earnings.

As a result, he is cautious about the recent slowdown in wage growth with any degree of certainty.

He said: “The noisiness of these indicators and the discrepancies between them should also cause some caution about the recent decline.”

“We would like to see more evidence on several indicators before coming to a conclusion that the situation is clearly downward.»

Financial markets currently expect the Bank's first rate cut to occur in May 2024.

Свежие комментарии