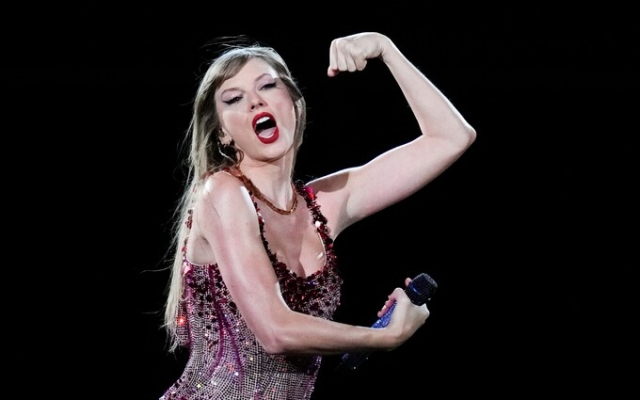

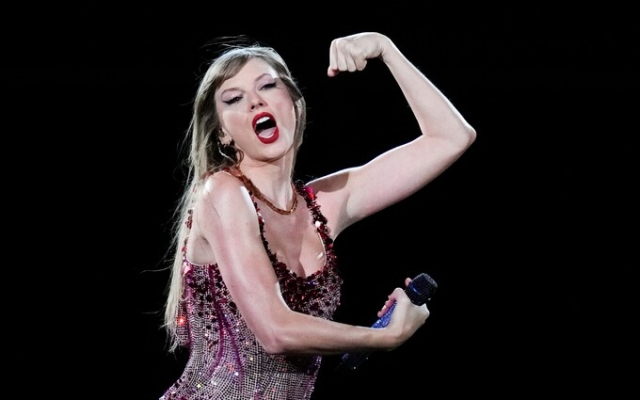

Difficulties in securing seats at Swift's concerts have brought renewed attention to the broken economics of the ticketing industry. Photo: AP Photo/Natasha Pisarenko

Difficulties in securing seats at Swift's concerts have brought renewed attention to the broken economics of the ticketing industry. Photo: AP Photo/Natasha Pisarenko

There are few fans as formidable as Swifties, as Ticketmaster learned the hard way.

After ticketing for Taylor Swift's Eras tour was thrown into chaos, the company found itself in crisis. At the eye of the storm, fans complained that delays and disruptions were driving up prices or preventing them from purchasing tickets altogether.

The anger was so intense that some Swifties, as Taylor Swift fans call themselves, sued Ticketmaster, accusing it of fraud, price fixing and anti-competitive behavior. The lawsuit was dropped this week after both sides said they were in talks to resolve the situation.

But this was far from an isolated incident: annoying power outages, long wait times and sky-high prices are increasingly becoming the norm for major concerts and festivals.

In part, it reflects growing demand for live events that has grown in the years since the pandemic.

But it also highlights the shortcomings of what critics say is a broken ticketing market that is creaking under the weight of high demand. Advertisers can snap up tickets and sell them at exorbitant prices, while some concertgoers are now facing huge ticket price hikes even if they go directly to the original seller.

Test focus is on Ticketmaster. , which dominates the market and has been called a «monopoly» by numerous critics.

As a bidding war begins for a rival retailer, is the ticket market ready for a much-needed shake-up?

The live events industry is vying on track to become the biggest economic casualty of the pandemic. Concerts, festivals and shows in the West End were the first to close when Covid hit and were among the last to reopen.

However, despite this — or perhaps because of this — the sector is now booming. .

According to a recent report from Allied Market Research, the global live events market was valued at $653 billion (£514 billion) in 2022 and is expected to reach $1.2 trillion by 2032.< /p>

Party-goers have flocked back to concerts and shows after quarantine, and demand continues to grow.

18% of Brits aged 13 and over have attended a live music event in the past 12 months, according to Luminate, which collects data on the entertainment industry. Even more people plan to go to a concert next year, with a third saying they plan to do so.

In addition to eager concertgoers, the boom is also being driven by artists who have been unable to tour during the pandemic, says Sarah McBriar. founder of AVA festivals and conferences. Many people strive to increase their income.

Demand is growing even as a deepening cost-of-living crisis forces many consumers to cut back on other forms of discretionary spending, such as streaming services.

p>

After years of cancellations, many organizers have been forced to raise prices. Tickets for Glastonbury 2024 cost £360, an increase of £75 in just two years.

«The ticket industry's response to rising demand has been to raise prices,» says Tatiana Chirisano, senior music industry analyst. at Midia Research.

“It may make sense on paper, but I believe the live entertainment industry should not take its customers for granted.”

However, rising prices failed to stop rising prices. so far it is scaring away players: the level of attendance is growing, and income is growing even more.

The amount of money Americans spend on live music events has jumped 91% over the past year, according to Luminate, and attendance is up nearly a third.

Live Nation Entertainment, formed through a merger. Ticketmaster and Live Nation in 2010 reported record results in the third quarter of that year, with profits of $484 million on revenue of $8.2 billion.

Cirisano says, “In a world where digital content is ubiquitous, , live entertainment is the only thing we have left and is therefore more valuable to consumers.”

Despite this renaissance, fans and politicians have expressed their frustration with a broken ticket market.

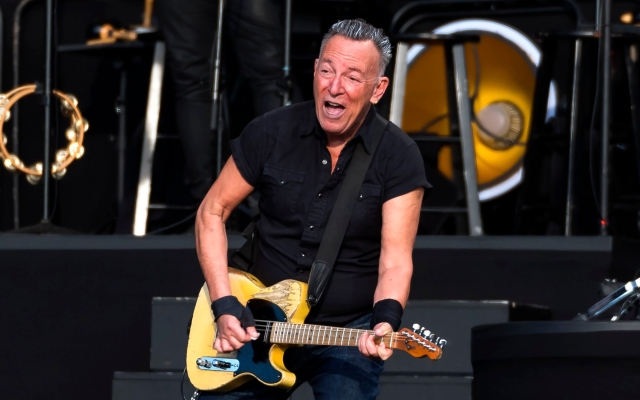

In addition to the Taylor Swift chaos, there have been complaints about Ticketmaster's use of so-called «dynamic pricing» during Bruce Springsteen's tour. This system tracks price changes based on demand levels and is designed to discourage advertisers by making bulk purchases prohibitively expensive.

Dynamic pricing, a system designed to prevent advertising, allowed Bruce Springsteen fans to pay more than $500 to see «The Boss.» Matthew Baker/Getty Images

Dynamic pricing, a system designed to prevent advertising, allowed Bruce Springsteen fans to pay more than $500 to see «The Boss.» Matthew Baker/Getty Images

In Bruce Springsteen's case, however, some fans charged up to $5,000 for tickets. Dynamic pricing has been used in the UK for tours including Harry Styles and Coldplay.

Joe Berthold, Live Nation's president and chief financial officer, admitted his company was a failure. He told senators earlier this year: “As a leading player, we have a responsibility to do better.”

For many, however, the problems are symptoms of more structural problems. Live Nation controls about 70% of the live performance market and ticket sales.

Amy Klobuchar, a Democrat who chairs the Judiciary Committee's antitrust panel, called Live Nation «the definition of a monopoly.»

This in itself is not illegal. However, critics have accused the company of anti-competitive behavior, saying the company's market dominance means it can effectively force artists, venues and other companies to work with it.

The US Department of Justice is investigating Live Nation and reportedly focuses on whether it is trying to enter into anti-competitive agreements with venues and artists.

Industry insiders say competition in the UK market is healthier than in the US, thanks to new players such as Dice, Eventbrite and Resident Advisor. However, there are still concerns about Ticketmaster's dominance.

“The business model they've created is that they have complete control and I think that's a very unhealthy place to be in.” music sector,» says McBriar.

«I would encourage artists and managers to take note of this because ultimately, if you don't have that balance of competition with independents and other big players, it won't lead to towards a common healthy market. «.

In the UK, industry leaders have also sounded the alarm about an out-of-control secondary market that allows advertisers to snap up tickets and sell them at extortionate prices.

< p>Tickets for the new Girls Aloud tour, which initially retailed for £48.50, were this week being offered on secondary ticketing sites for over £2,000 each.

In 2021, the Competition Authority markets has developed a series of recommendations to help make the ticketing sector work better for visitors.

But Tom Keel, interim chief executive of UK Music, says the government has failed to address the problem. He called on Business Minister Kemi Badenoch to hold an urgent summit.

“The key issue is that we stop any practice of exploiting fans,” he says.

Keel points to new laws in Ireland that prohibit the resale of tickets above face value, as well as other measures including possible price caps.

Calls for intervention come as one of Ticketmaster's competitors, See Tickets, prepares pass from hand to hand. The seller was put up for sale by French media giant Vivendi.

The auction, which is expected to fetch €300 million, has attracted the interest of US entertainment conglomerate Anschutz Entertainment Group (AEG). which owns the O2 Arena.

CTS Eventim, the German company that jointly owns the Hammersmith Apollo with AEG, is also among the interested parties.

AEG is second only to Ticketmaster in the US market thanks to to its AXS division, and CTS Eventim also has its own core ticketing business, meaning a partnership with either would open the door to a major new competitor.

Nottingham See Tickets, formerly owned by Andrew Lloyd Webber's Really Useful Group, sold 39 million tickets to music, sporting and other events last year. It also runs the Love Supreme music festival in East Sussex.

Some are skeptical about whether the merger will make a real difference, improving service or lowering prices through increased competition. But most agree that as live events continue to grow, fundamental changes are needed.

«Ultimately, it's the artists and fans who will suffer in the long run,» says McBriar.

A Ticketmaster spokesman said: «The live entertainment business has never been more competitive, and AEG in particular is a strong global competitor in all segments of the industry.»

«Live Nation and Ticketmaster may be the biggest players, but only because we provide the best service to artists, venues and fans.»

Свежие комментарии