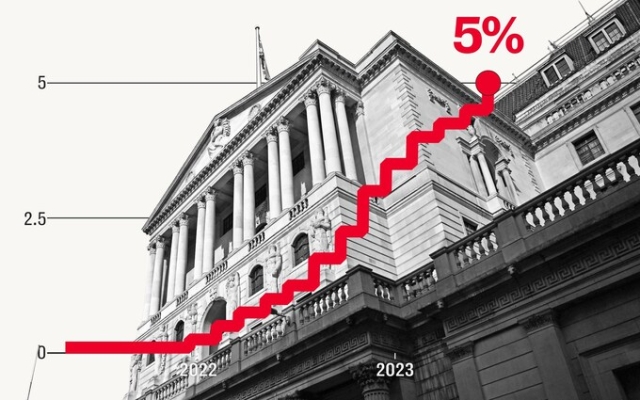

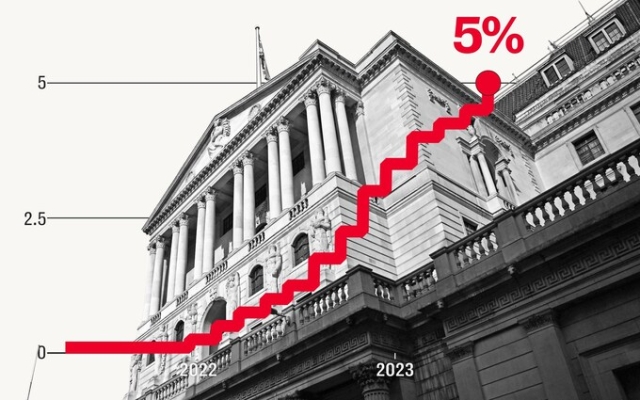

Andrew Bailey wasn't trying to embellish his post. The Governor of the Bank of England was tough when he announced an interest rate hike from 4.5% to 5%.

“Inflation is still too high and we have to deal with it,” Bailey said. «We know it's tough — many people with a mortgage or credit will understandably worry about what this means to them.»

His message was loud and clear. The pain is not far off, and families must be prepared for the consequences.

Interest rate 2,306 boe

Bailey is raising interest rates in full force as inflation stubbornly refuses to return to its 2 percent target.

In May, prices rose 8.7% year-over-year, as they did in April . Below this total, core inflation, excluding food and energy, is rising, while price increases appear to have shifted from goods to services.

All this indicates that inflation is becoming more deeply rooted in the economy. This leaves the UK with higher inflation than other major countries including the US, France and Germany.

“We raised rates to 5% following recent data that showed further action was needed to reduce inflation. Bailey said.

“If we don't raise rates now, things could get worse later. We are committed to bringing inflation back to the 2% target and will make the decisions necessary to achieve this.”

2306 UK inflation comparison. and workers that he is determined to quell inflation.

This is because a key part of controlling inflation is managing expectations. If employees expect a price hike, they demand a pay rise. If bosses expect higher costs, they raise prices. With over a million jobs, workers can easily demand more money.

To put it bluntly, Bailey hopes to reassure the country that inflation has finally been brought under control.< /p>

But restoring confidence and crushing inflation will not be easy or pleasant. Now the population will bear the consequences by paying more for mortgages and business loans.

2306 vacancies

This will be a shock to the system. Most companies expect the Bank of England to cut interest rates later this year or early next year, according to a study by Oxford Economics. What's more, mortgage interest rates have already more than doubled over the past year, hitting households hard as their fixed-rate loans come to an end.

The National Institute for Economic and Social Research estimates that more than 1 million households will run out of savings by the end of this year due to higher interest rates.

“Rising interest rates to 5% will push millions of households with mortgages to the brink of insolvency ”, said Max Mosley, economist at the Institute.

“No lender expects a household to withstand a hit of this magnitude, so the government shouldn't either. Some investment must be made in reimbursement agreements giving households and lenders the ability to create payment plans that work for each other.”

1605 short-term mortgage

Handouts are almost taken for granted and Rishi Sunak is expected to visit again to help and provide assistance to needy borrowers. But government sources indicate that those who expect financial assistance this time will be very disappointed.

“There must be a moment when the veil falls from your eyes regarding the magical money tree that started during the pandemic,” the post reads. one senior source.

“It will be that moment. It is very noticeable that Asian countries that have not taken advantage of the magic money tree in the way that Western Europe and America did, do not have an inflation problem.

The Bank also has another obstacle: 85% of households today have fixed rate mortgages, up from 50% in 2008. will expire within the next few years.

The MPC reiterated that the high proportion of fixed-rate mortgages meant that «the full impact of the bank rate hike to date will not be felt for some time.»

p>

This suggests that the rates may need to be higher for a longer time in order for more people to feel pain. Politicians will have to balance this with the pain experienced by tenants who are seeing their costs skyrocket as landlords, many of whom have interest-only mortgages, are raising rents to try and keep up with payments.

All this does not bode well for growth. Even before this latest rate hike, the economy was already effectively stagnating.

Expected economic hit

GDP rose by a disappointing 0.1% in the three months to April. Employment is at an all-time high, but output is barely changing.

It won't take long for the UK to plunge into recession, joining Germany and the eurozone, which are already shrinking.

Luke Bartholomew, Senior Economist at Abrdn, says these rate hikes mean the UK is heading in the same direction .

“It is increasingly difficult to see how the UK avoids recession as part of the process of lowering inflation,” he says, adding that this “significant rate hike is likely to be seen in retrospect as an important milestone on the road to this recession.» /p>

Suren Tiru, director of economics at the Institute of Chartered Accountants of England and Wales, says the move may even be unnecessary, making a recession unnecessary.

“Rising interest rates will do little to address current concerns about inflation, given the significant time lag between the rate hike and its full impact on the real economy,” he says.

“With most of the rate hikes over the past year not yet reaching borrowers and the broader economy, by continuing to tighten lending conditions, the Bank risks overcorrecting past mistakes and unnecessarily risking a recession.”

This is bad news for living standards households and bad news for a growth-focused government that needs a vibrant economy to enable it to cut taxes before the next election.

Vivek Paul, chief investment strategist at BlackRock Investment Institute in the UK, says that the long-term picture is even worse.

“Whether the UK goes into a technical recession or not depends on the big picture: expected cumulative growth, combination Bank’s own estimates with realized data are less than 3% over the four years 2022 to 2026 ”, he says.

“Only two other occasions in the last 35 years have been as grim for such a long time.

Bailey may have been talking tough this week. But for Britain, this is just the beginning. In the coming years, the economy will not be easy.

Свежие комментарии