Rishi Sunak and his Chancellor Jeremy Hunt devoted another five years to the costly triple block system. Photo: Stéphane Rousseau/Poole via REUTERS < p>Splashing money in Westminster was supposed to have gone out of fashion with the arrival of Liz Truss.

Rishi Sunak and his Chancellor Jeremy Hunt devoted another five years to the costly triple block system. Photo: Stéphane Rousseau/Poole via REUTERS < p>Splashing money in Westminster was supposed to have gone out of fashion with the arrival of Liz Truss.

Last year's short-lived prime minister promised unlimited spending on energy bills coupled with attractive cuts taxes in a promise to boost the economy, but instead unwittingly provoked a collapse in the financial markets.

This meant that the agenda became dull when Rishi Sunak and Jeremy Hunt came to power by raising taxes and limiting spending.

a pledge to spend £28bn a year on green investment given the rising interest on the debt.

But all vows to make tough financial decisions seem to have been forgotten.

Both parties simultaneously committed to one very large spending plan: the extension of the triple pension guarantee, which means it will likely last at least another five years in Parliament.

Mel. Stride, the pensions minister, said the Conservatives have a «special debt to pensioners.»

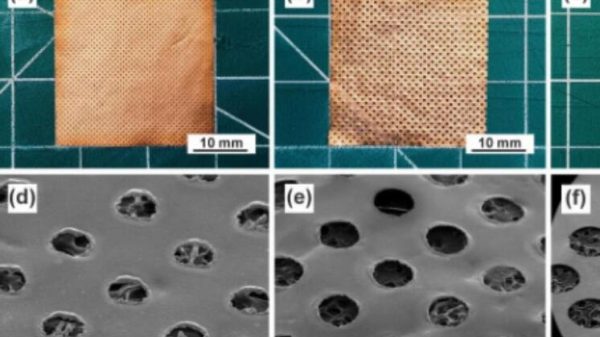

Coalition-era policies increase pensions by the maximum of inflation, average wage growth, or 2.5 percent. It is essentially a ratchet that ensures that the state pension grows faster than workers' wages over time.

3006 state pension

Extending it after the next election means that the five-year deal made in 2010 must be implemented. has been operating for at least two decades.

Has the triple lock already done its job? And can the country afford to keep expanding the scheme when finances are struggling?

Steve Webb, who was Pensions Minister for the Coalition, says the policy was necessary at the time to boost incomes for distressed retirees. .

“Because the state pension was so low, it needed a safety net,” he says.

“For more than 30 years, the state pension has been pegged to prices. Wages rose a lot, so the pension fell in value compared to people's earnings. If you went from pre-retirement pay to post-retirement, the drop got bigger and bigger.”

This policy has definitely worked in terms of narrowing this gap. Back in 2010, the standard state pension for a single person was £97.65 per week. The basic pension is now £156.20, up 60%.

In comparison, the average weekly earnings of workers rose from £442 per week to £648, a 46.6% increase.

In terms of purchasing power, consumer prices increased by 46.1%. This means that the average worker lives no better than in 2010, but the state pension in stores is much higher.

In a time of fast-paced inflation, especially when basic costs such as domestic electricity bills and food prices are on the rise. , the triple lock helped keep vulnerable older people out of the worst this year.

Alfie Sterling, chief economist at the Joseph Rowntree Foundation, says “it has been very effective in helping retirees get out of poverty. It is a very successful and important part of the welfare state apparatus.”

So much for effect. How about cost? The state pension was worth £104.3bn in 2021-22, according to the OBR. It will be worth £147.3bn by 2026-27, up 41 per cent from both the triple-lock ratchet and the rising number of retirees.

3,006 pension costs

On the contrary, Government revenues – mostly from taxes – are expected to grow by just 29% over the same period, to £1.18 trillion.

This means that one pound out of every eight that the government receives will soon be spent on the state pension.

p>

All this is happening against the backdrop of growing financial tensions.

State debt has risen to the same size as GDP and the government is expected to borrow about £130bn this year alone.

Pressure is mounting to increase spending on the National Health Service and social assistance, raise wages pay public sector workers, strengthen the military and lower taxes.

Carl Emmerson of the Institute for Financial Studies says that, overall, the triple lockdown “provided a larger increase in income for retirees at a greater cost to the government than we could have said in 2010.”

“ In the very long term, this is a mathematical fact that it's unsustainable because you can't have something that grows faster than the average profit forever,” he says.

“At some point we have to get rid of the triple lock, the only question is when we want to do it?”

Stirling says the government can afford to keep this policy for now, which is especially important when retirees are suffering from rising energy bills, food prices and other basic expenses.

It also supports additional support for retirement loans and housing allowances to help the poorest retirees.

3,006 government receipts

Webb, who now works for consulting firm LCP, says there is no rush.

>

“The point was to try to undo the damage done by 30 years of [pegging for inflation]. You can argue that in 10 or 15 years the damage will not be repaired,” he says.

“The natural end will come when the state pension reaches the agreed share of the average wage.”

After that, the double lockdown might make more sense, increasing pensions more in line with typical wages.

In contrast, David Willetts, a former minister and now chairman of the Resolution Foundation, says the government can declare victory with the triple lock and follow the link to earn money.

“Triple lock job done. Given that money is tight, for any given benefit budget, there comes a point where you have to say do we have a fair balance between the amount we spend on retirement benefits and the amount for families?” says Lord Willetts.

The Resolution Foundation think tank estimates that the poorest 20% of retirees have higher incomes than the poorest 20% of non-retirees, he says.

Alternatively, if the triple lock holds, one solution could be to increase retirement age, says Lord Willetts, capping the total bill while increasing beneficiary payments.

The age has risen from 60 for women and 65 for men to 66 for both, and will rise to 67 later this decade .

However, this comes with risks.

Ros Altmann, a former pension minister, fears that raising the retirement age to fund the triple lockdown «prefers the wrong people.»

Wealthier retirees live longer and therefore benefit the most, while the poor – typically with shorter life expectancy – miss out on years of benefits.

“Some will die before get anything, the higher you age,” Baroness Altmann says, suggesting a move to a double lock by focusing support on those who are poorer or in poor health, for example by allowing them to receive a reduced rate pension until they reach normal age. .

The triple lock is a «political totem signal,» she says.

«It's a lazy way of saying we want to help retirees, but you're not really helping those who needs help most.”

It may take another round of chaos in the borrowing market before ministers are ready to consider reform.

Свежие комментарии