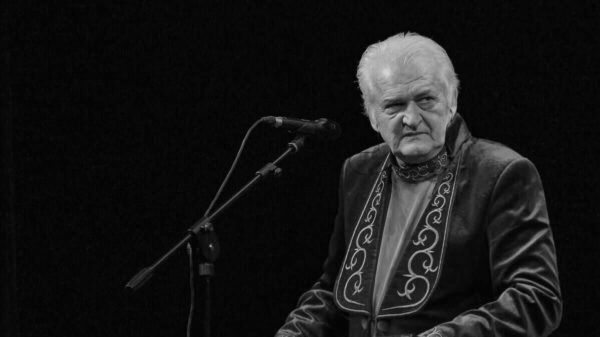

Rishi Sunak and Jeremy Hunt have frozen tax thresholds to boost revenue. Photo: PAUL ELLIS

Rishi Sunak and Jeremy Hunt have frozen tax thresholds to boost revenue. Photo: PAUL ELLIS

Rishi Sunak's raid on workers and businesses will be costly The country will face an extra £100 billion in taxes by the end of this decade, while rising net migration increases pressure on public services, the Institute for Fiscal Studies (IFS) has warned. .

A respected think tank has said Britain's tax burden will rise by 2030 as frozen tax thresholds mean inflation forces more people into higher brackets and corporation tax puts pressure on businesses.

This means that the tax burden will rise sharply even after the Autumn Statement tax cuts. Chancellor Jeremy Hunt is reported to be considering cuts to national insurance and vaping tax — as opposed to income tax — in next week's Budget after revealing he will have less money to spend than expected.

< p>Britain will pay an extra £66 billion this year compared with a scenario in which public finances remained at pre-Covid levels, according to the IFS. By 2028, the rise in tax revenue would be equivalent to £104 billion in today's money.

The think tank said the growing burden was the result of the Prime Minister's conscious decision to increase the size of the government. .

The IFS said the Chancellor's decision to continue Mr Sunak's tax raid would see the tax burden rise from 33% of GDP before the pandemic to a record 37.7% by the end of the decade .< /p>

Mr Hunt froze income tax thresholds for six years and increased corporation tax from 19% to 25% last year.

The think tank also warned that rising net migration means per capita spending on public services will barely rise until the end of the decade, leaving a £25 billion black hole in public spending.

Now The government is on track to cut spending. spend £150 less per person on public services by 2028 as population growth driven by rising immigration pushes Whitehall budgets higher.

The Office for National Statistics estimates the population will grow from 67 million in 2021 to 73.7 million by 2036, with 6.1 million of this growth coming from net migration.

At IFS said faster population growth could increase revenues by raising taxes. . However, public sector spending per capita would rise by just 0.2% in the post-election year under current plans.

The think tank said: «New long-term demographic projections, driven mainly by higher expected levels of net migration, will help increase the size of the economy but will make existing spending plans even more challenging on a per capita basis.»

Office for Budget Responsibility , the government's tax and spending watchdog, expects the government to increase spending on public services by an average of 0.9% over the next parliament.

The IFS said this would result in spending rising by 0.9%. ,5%. per year per person.

However, he added: “If we take the latest ONS population forecasts, average annual growth in real per capita spending falls to just 0.2% a year.”

The IFS has warned that a £25 billion cash injection will be needed to stem the decline in per capita spending.With little free money in the Budget, this implies deeper cuts in spending in Whitehall departments outside the NHS, defense and schools will need to be ring-fenced if the Chancellor really wants to maintain levels of investment.

Carl Emmerson, deputy director of the IFS , said higher net migration does not automatically improve public finances. .

He said: “The temptation for the chancellor is that people coming here and working will get a little more income, but perhaps he won't give public services the money they need to meet extra needs because more people are bound to increase demands » «.

He added: “The big win for your public finances will be people coming in without children, working a little bit and then sort of going home because there are no childcare costs, no pension costs and there is not much impact on National Health Service costs. Whereas if they are more like the people who are already here, it won't make much of a difference to the public finances.»

Mr Emmerson described the Prime Minister's tax and spending legacy as «absolutely obvious where there was an increase in the size of the state.»

He added: “It’s not just the pandemic. Some of them look like a reaction to changing demographics, for example. The [free] childcare package last year [was also] a big expansion of the government's role, which had nothing to do with the pandemic.

“I think this government has decided what it wants — or cannot escape the idea that spending should be higher as a share of national income, and so introduced taxes to achieve this.»

< p>The IFS review comes after David Miles, executive member of the Office for Budget Responsibility (OBR), warned that waves of new migrants will not solve Britain's tax and spending crisis.

An Imperial College professor warned last month that It is unclear whether «persistently high levels of net immigration, contributing to a larger labor force,» could «lead to sustained financial improvement.»

Separately, Make UK, an industry lobby group, called for the budget and autumn statement to be scrapped, a radical move that would see tax policy set at the start of parliament and «only changed in exceptional circumstances». Factory bosses said investment and activity were being held back by economic policy shifting too much.

A Treasury spokesman said: “We have provided hundreds of billions of pounds during the pandemic and Putin's energy crisis, and we have handled them responsibly » government finances since then meant we could make significant tax cuts in the autumn.

“We announced the biggest business tax cut in UK history to help firms invest more cost effectively, worth £55 billion sterling in corporation tax savings, while the average worker will save £1,000 in tax next year compared to what they would otherwise have done, thanks to recent National Insurance cuts and inflation rising to the starting threshold.» .

Свежие комментарии