Nigel Farage has proposed a £40 billion bank raid to plug holes in public finances.

The leader of the UK Reform Party wants to stop paying interest to commercial banks on the reserves they hold at the Bank of England.

His policy, which partly echoes the work of the European Central Bank, promises to save the Treasury billions every year at a critical time moment for the debtor country.

It also comes at a critical political moment, with just weeks to go until the election and both Labour and the Tories keen to convince voters they are the safest pair of hands to look after the economy.

But whoever enters Number 10 on July 5 will be under severe constraints from an unlikely force: the Bank of England.

Jeremy Hunt had to funnel more than £44bn into the central bank last year.

< p>That's more than some government departments' budgets combined. Defence, for example, will get just under £33 billion between 2024 and 2025.

Hunt — or Rachel Reeves, if Labour wins — could expect to sign another £34.5 billion cheque to the Bank this financial year.< /p>

It will be delivered, and around £20 billion a year will flow from Whitehall to Threadneedle Street for the foreseeable future.

The reason? The Bank of England's crisis-era money-printing spree, and the somewhat unusual way it's been organised.

Threadneedle Street raised hundreds of billions of pounds to buy bonds during the financial crisis and pandemic, preventing a financial crisis and lowering borrowing costs in the wider economy.

Buying bonds creates financial risk. Successive chancellors have offered the Bank of England compensation for any losses. They did this because the idea of losing money seemed a distant threat to them.

This bond buying, known as quantitative easing (QE), made the Bank a profit when interest rates were low, which was passed on to the Treasury.

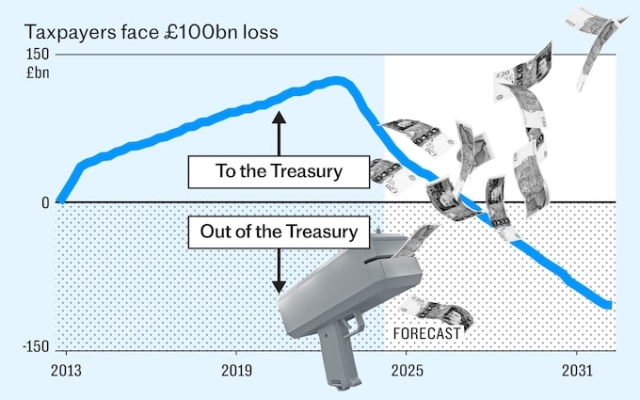

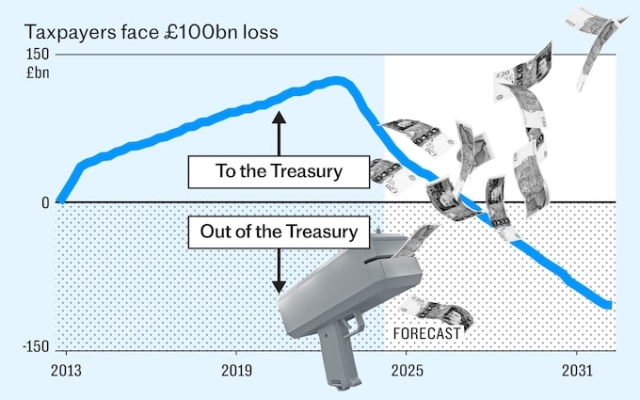

The Treasury has received £124bn from the arrangement until 2022.

Now that borrowing costs are high, the Asset Purchase Fund (APF), as the Bank calls the scheme, is wasting money. And it is taxpayers who must compensate for the losses.

The Office for Budget Responsibility estimates that quantitative tightening (QT) — the process by which the Bank reduces its bond holdings — will cost taxpayers more than £106bn by 2032.

The bill is so big that it effectively makes the Bank of England the most important player in the government's fiscal policy — taxing, spending and borrowing.

«The sale of the Bank's assets limits the government's spending under its current fiscal rules,» says Rob Wood of Pantheon Macroeconomics.

Government finances are already constrained. The government is only meeting its target of reducing debt to GDP by less than £9 billion in five years.

With little leeway, key government measures are taken or delayed due to the highest financial returns in forecasts.

Worse, the cost of QT to the Treasury is highly unpredictable.

Last July, the OBR forecast that the net loss from the scheme would be £63 billion. By November, the predicted black hole had doubled in size to £126 billion. It then fell slightly to £106 billion by March this year.

The overall cost depends both on the policies set by Bank of England officials and on interest rates, which appear to remain high for a long time.

Decisions on QT terms and interest rates are made by the Bank of England — its operational independence is considered sacred.

But the fiscal straitjacket the measure places on the government has sparked outrage in some quarters.

“No one disputes the independence of the Bank of England in setting short-term interest rates and forecasting inflation,” says John Redwood, a veteran parliamentarian for Conservatives and former Cabinet minister.

“But no one should challenge the right of the government and Parliament to set fiscal policy. If the Bank continues to sell bonds at large losses, it will free up important cash needed for other purposes.”

Should it be like this? Short answer: no.

“QE and QT are not an independent policy of the Bank of England, but a joint policy with the Treasury,” says Sir Jacob Rees-Mogg, a former business secretary.

“No other central bank does this.” so that it can be done differently and at less cost.»

The Federal Reserve took a completely different approach. The US central bank actually books the losses and promises to pay them off over time, rather than passing them on to the taxpayer immediately.

The Fed can do this because it has more revenue streams than the Bank.

First of all, it retains the income from the issue — the profit received from printing banknotes. Andrew Bailey noted last week that Britain has no such system.

“This option is not available to us here in the UK. Thanks to the Banking Charter Act 1844 and the Currency and Notes Act 1928, all issue proceeds received by the Bank's Issue Department are paid directly to Her Majesty's Treasury,” the Governor said.

“At the current rate this is around £4 billion a year. Thus, we have neither retained positive cash balances in the NPF as they accumulated when the bank rate was low, nor do we have access to a future income stream against which we could offset negative cash flows in the future, as others do central banks. the banks are getting closer to this.”

Of course, parliament can change the laws that the governor refers to. This could allow the Bank to withhold £4 billion a year from banknote printing to cover losses from quantitative easing.

The process will be slow — it will take more than a quarter of a century to cover the net loss of £106 billion.

p>

But at least it would represent a predictable loss of income for the Treasury, rather than risking large and unpredictable costs to the current regime.

If following the Fed's lead is not possible, the UK could copy the European Central Bank (ECB).< /p>

The ECB keeps bonds. he purchased the bonds before they matured, that is, he receives the full face value of the bonds.

In contrast, the Bank of England is actively selling part of its bonds. When interest rates rise, the market price of bonds falls.

The bank bought when rates were low and is now selling at a loss.

Another difference is how the Bank and the ECB treat the new money they created to buy these bonds.

The ECB pays commercial banks less interest on the reserves they hold at the central bank.

It doesn't pay out any of the portion of reserves that lenders are forced to keep under the rules, but just gives them a return on the money they hold above that minimum level, in a process known as tiering.

By contrast, the Bank of England pays a base rate of 5.25% on all reserves, which is more than it receives in yield on the bonds in its QE portfolio.

Reform, the party led by Nigel Farage , wants to cancel these payments to commercial banks.

The party's draft manifesto says that in the first 100 days of the next government «the Bank of England should stop paying interest to commercial banks on QE reserves.»

“Other central banks don't do this. Senior economists and a former deputy governor of the Bank of England agree. This saves £30-40 billion a year,” says Reform.

Redwood argues that since the Bank only started paying interest on reserves at all in 2006, it is not difficult to imagine reversing the decision, at least at least in the future. part.

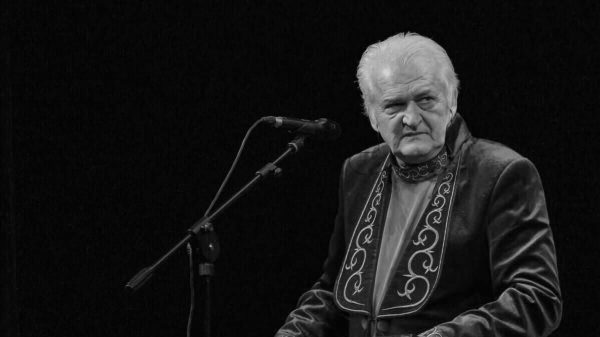

Sir John Redwood proposes to review the Bank of England's reserve payments. Photo: Richard Townshend Photography

Sir John Redwood proposes to review the Bank of England's reserve payments. Photo: Richard Townshend Photography

“The Bank of England should take a hard look at how the European Central Bank is doing a much better job of controlling losses. There's no need to sell bonds into the market at a big loss,” he says.

“And you can control the interest rate you pay on deposits, as the ECB and the Bank of England have done. I used to.”

Bailey argues that ECB rules work differently. But politicians are becoming increasingly impatient.

Ultimately, the costs of QE, which successive chancellors, both Labor and Conservative, have promised to pay for, cannot be magically removed. Someone has to pay.

Cutting payments to banks is effectively a new tax for the City. Allowing the Bank of England to retain seigniorage income would mean losing a long-established source of income for the Treasury.

However, moving to a Fed or ECB-style system would loosen the government's fiscal straitjacket and potentially free up billions.

Conservatives have so far shown little inclination to change the rules, and Labor is understood to have no such plan either.

It may be easier to change borrowing rules to reduce the immediate burden, although Reeves has so far promised only to tighten them.

In its current form, Threadneedle Street will be a drain on the state budget for years to come.

This article was first published on May 30. It was updated on 10 June to reflect proposals made by Reform UK

Свежие комментарии