The Bank of England has given its strongest signal yet that it is preparing the way for a summer rate cut.

With inflation falling and the economy showing signs of cooling, Andrew Bailey said it was likely borrowing costs would fall, perhaps sooner than investors expect.

Threadneedle Street has already outlined the three most important indicators it looks at attention when it comes to the timing of rate cuts. Policymakers want to see wages, services inflation and the labor market continue to cool.

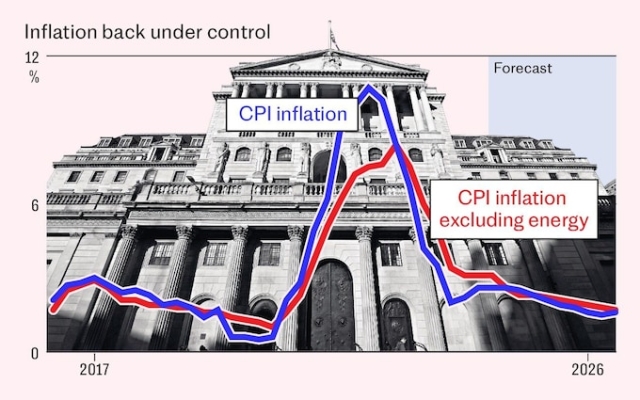

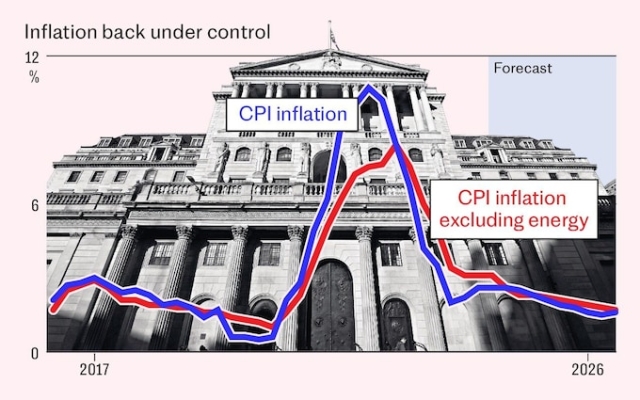

The bank believes headline inflation has already fallen to 2% and is likely to fall slightly below target this month . .

The main driver is lower gas and electricity bills, with the energy price cap set to fall by 12 percent, which is expected to lower the headline rate by about 1.2 percentage points in April, according to economist Sanjay Raja of Deutsche Bank. Sanjay Raji of Deutsche Bank.

There are also signs of stabilization in food prices. Prices for some basic food products, such as bread and milk, are already cheaper than a year ago.

The bank said «fierce competition» from discount supermarkets such as Lidl and Aldi was also likely to keep food inflation to between 2% and 3%. until the end of the year.

However, there are signs that price growth in the services sector remains stable. The Monetary Policy Committee (MPC) noted that services inflation has «declined but remains high.»

With an annual rate of 6%, some MPC members have explicitly stated that they expect further reductions before considering rate cuts.

This is partly because the services are such a wide range: it covers everything from haircuts to theater tickets and car repairs.

Inflation in services is higher than in goods due to rapid wage growth. The bank expects wage growth to average around 5.5% this year. However, wage increases for workers in the “consumer sectors” are likely to be much higher, at 7%. A nearly double-digit increase in the minimum wage was «overwhelmingly» cited as the main driver of the wage increase.

However, wage agreements in the second half of the year are likely to be «substantially lower.» than those observed so far in 2024, suggesting that average wage growth is likely to continue to decline.

This is partly due to the expected rise in unemployment.

So far, the labor market has been remarkably resilient to soaring interest rates. The number of advertised vacancies has fallen from a peak of just over 1.3 million two years ago to just over 900,000 now, still high by historical standards.

However, the MPC expects the unemployment rate to rise. over the next two years, the figure will rise from 3.8% to 4.8% as higher borrowing costs curb activity.

This is higher than the average observed over the past decade and should take some of the heat off the labor market, reducing pressure on employers to raise significantly higher wages to attract and retain staff.

While the authorities' main concern is setting rates is as follows. inflation, they are also required to take growth into account.

Traditionally, interest rates rise when the economy grows too quickly, when demand exceeds supply and causes prices to rise.

But it is difficult to say that the economy is now experiencing a crisis. The economy ended the year smaller than it was at the start of 2023, due to a brief recession.

From this perspective, annual growth would recover painfully slowly, rising to around 1%. by the end of this year, and then by mid-2027, this figure will increase to 1.6%.

This is below the “speed limit” above which the economy generates too much inflation. According to Bailey: “Demand will gradually lag behind supply, leading to some economic contraction.”

There is therefore no need to keep interest rates high. In fact, there is a danger that higher borrowing costs will act as an unnecessary drag on growth as inflation is brought under control.

The rule of thumb for central banks is that changes take between 18 and 24 months. interest rates to fully impact inflation and the economy as a whole. The Bank's own forecasts suggest that if interest rates remain above 4% next year, inflation will fall well below the 2% target by the end of next year, depriving the economy of momentum.

In other words, the Bank needs to take a stand path to lower rates below 4% by the end of the year.

Another illustration of weak demand is the high level of savings: households are stashing away more money instead of spending. this.

Some will rebuild buffers after the cost of living crisis. Others save money out of fear of losing their jobs. However, more people are being enticed by decent savings rates after years of low returns on cash in the bank.

Households are now saving 6.5% of their income, excluding pension savings, according to the Bank of England. Part of this amount is kept in high-interest term accounts, so families will not be able to spend it even if they want to.

Apart from the quarantine caused by the pandemic, when families were locked at home and could not spend money normally, this is the highest level of savings since the Bank began reporting. in 1997.

Given that households are clearly looking to save, this suggests the Bank can cut interest rates without unleashing a spending boom that could fuel inflation.

Traders in financial markets have cut bets on rate cuts in recent months, partly because U.S. inflation has proven more resilient than expected. What happens in the world's largest economy affects everyone.

But Bailey stressed that the Bank will not wait for the US Federal Reserve to start cutting rates before cutting them in the UK.

< p>“There is no law that says the Fed must act first. Moreover, we have a mandate and a target related to domestic inflation,” he said.

Bailey reiterated that inflation dynamics in the UK are different from those in the US: «America… has stronger demand, and so I think it's important to make that distinction.»

Some indicators show that the US job market is hotter than the UK. While the unemployment rate is about the same, just below 4%, the U.S. job vacancy rate remains well above pre-pandemic levels.

Bailey said, “Obviously we take the rest of the world into account as it impacts inflation.” in this country, but let me be clear that there is no law that says we can only act after the Fed has acted, and that is not something that is ever discussed in the MPC.»

Amid encouraging signs inflation, a cooling labor market and Bailey's clear statement of intent, traders increased their bets on an imminent rate cut. Investors are now almost certain that borrowing costs will fall next month.

Свежие комментарии