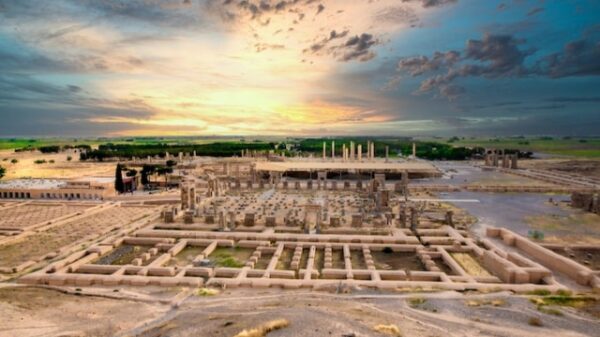

Jeremy Hunt's budget also left the government with little fiscal space to deal with rising borrowing costs. Photo: Jordan Pettitt/PA. Wire

The OECD has warned that Jeremy Hunt's clandestine tax raid will put 'significant' pressure on British households over the next few years.

The Paris-based organization announced the chancellor's decision to freeze income tax thresholds. by 2028 “will significantly increase fiscal pressure on households, forcing 1.7 million people to start paying income tax, and 1.2 million people to pay higher rates.”

This happened after The OECD warned that global financial markets could be in turmoil due to persistently high interest rates.

The group said that rising borrowing costs could put the global financial system under severe stress and lead to a sharp jump in stock and bond prices . falls.

The OECD predicts an average growth of 1.4% in its 38 member countries, but says the recovery has been 'brittle'.

“One of the key concerns is that inflation may remain more resilient than expected . Significant additional monetary tightening may then be required to bring down inflation, raising the likelihood of a sharp revaluation of assets and a repricing of risks in financial markets,” the OECD Economic Outlook says.

She added that she expects the UK to avoid a recession this year, although the economy is expected to grow by just 0.3% compared to the previous forecast for a contraction of 0.4%.

However, The OECD said UK inflation will be among the highest among the 38 members of the industrialized countries club in 2023 as food prices and core inflation remain consistently high.

2605 UK inflation

The group's criticism of the so-called “fiscal burden” that forces workers to give most of their wage supplement to the tax authorities because thresholds do not match the cost of living has already been compared to a 4p base rate increase when combined with employer contributions to national insurance, which by 2027-2028 will bring almost 30 billion pounds a year.

The OECD has warned that there is “little room in the budget” for tax cuts and the UK's rising stock of debt “leaves the government heavily exposed to changes in interest rates”.

Economists say the Treasury could be forced to pay billions pounds more than interest on the UK debt as “significant additional tightening of monetary policy” around the world may be needed if inflation proves to be sustainable.

The OECD's warning comes even as Western central banks have already hiked interest rates to the highest levels at an aggressive pace in recent decades, to highs last seen during the financial crisis.

Mr Hunt's low budget buffer means that the UK government will be highly exposed to further significant increases in borrowing costs, the OECD warned in its carefully monitored forecast.

Debt skyrocketing – public sector net debt as a % of GDPa

The chancellor left himself only a £6.5bn buffer to comply with his own fiscal rule, which calls for the debt-to-GDP ratio to fall within five years, the lowest of any chancellor since at least 2010.

While the OECD raised its UK growth forecast for 2023, warning that low margins could hamper a fragile recovery:

“The [UK] outlook is surrounded by significant risks. The high interest burden on public debt and the recent decline in average debt maturity make public finances vulnerable to fluctuations in bond yields,” the OECD said in a statement.

Its forecasts underline that UK inflation continues,” meaning that it is spreading to different parts of the economy.

This is usually a warning sign that becomes permanent.

This was also reflected in separate OECD data on Tuesday, which found that the UK had the most high G7 core inflation rate of 6.2 percent in April.

UK inflation is expected to average 6.9 percent in 2023, more than three times the Bank's target for England 2%. It will then drop to 2.8 percent next year.

The IGO also revised its assumption of interest rates from March, forecasting that they will peak at 4.75 percent instead of 4.25 percent.< /p>< p>Inflation will approach the Bank's target of 2% only by the end of next year, the report says.

Recent Comments