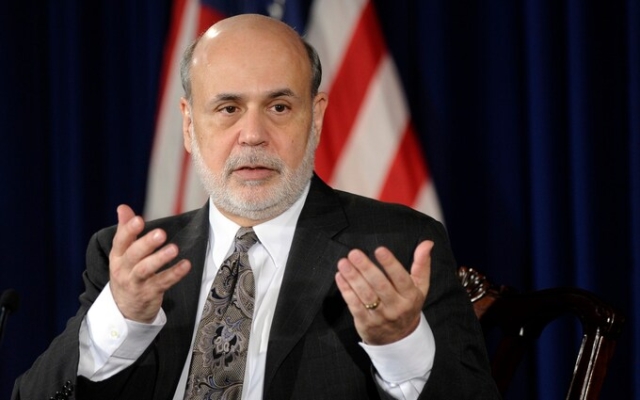

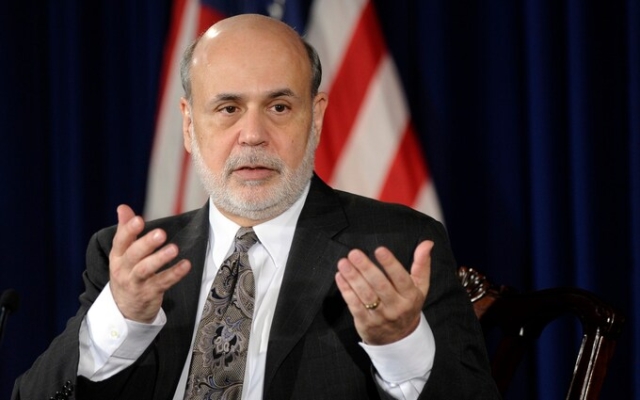

Ben Bernanke was chairman of the US Federal Reserve during the 2008 financial crisis. Photo: Susan Walsh/AP

Ben Bernanke was chairman of the US Federal Reserve during the 2008 financial crisis. Photo: Susan Walsh/AP

The Bank of England asked an American money-printing architect during the financial crisis to analyze forecast errors.

Ben Bernanke, former chairman of the Federal Reserve, was appointed after MPs and economists have blamed Threadneedle Street for repeated setbacks due to the UK's persistent inflation problem.

David Roberts, Chief Justice of the Bank, asked Mr Bernanke to study his forecasts «in times of considerable uncertainty».

p>

He will start unpaid work this summer and report to the Bank next year. .

Inflation peaked at 11.1% last October and remains at 7.9%, almost four times the Bank's target of 2%.

Mr Bernanke chaired the Federal Reserve from 2006 to 2014, spearheading the rich world's response to the financial crisis.

This included using quantitative easing (QE) as the main policy to support economic activity.

Mr. Bernanke said: “Forecasts are an important tool for central banks to assess the economic outlook. But it would be right to reconsider the structure and use of forecasts and their role in policy making in the light of major economic shocks. Therefore, I am delighted to be leading this effort for the Bank.”

Andrew Bailey, Governor of the Bank, added: “Dr. Bernanke is a renowned and award-winning economist whose distinguished career makes him the ideal person to lead this review.

“The UK economy is facing a series of unprecedented and unpredictable shocks. The review will allow us to take a step back and think about where our processes need to adapt to a world in which we increasingly face significant uncertainty.” groupthink” in the profession of economist.Central banks in most countries of the world, including the United States, failed to anticipate a surge in inflation after they unleashed a new wave of money printing during the pandemic.

< p>Dame Andrea Leadsom, former business secretary, said she was «delighted that the Bank is properly reviewing its own catastrophic forecasts» and called for a serious challenge to the way officials make forecasts.

«Ben Bernanke should be able to put his years of experience to good use, but it's certainly in our best interest to see some pretty solid arguments in the Bank. Groupthink is not necessary.”

Sir Ian Duncan Smith, former leader of the Conservative Party, welcomed the arrival of the heavyweight economist to Threadneedle Street.

«Given Bailey's infamous reputation for missing out on a dangerous rise in inflation that led to a dangerous cost-of-living crisis, I'm sorry that Bernanke will not replace Bailey now,” he said.

Parliamentarians have been particularly vocal critics of the Bank's performance.

Harriette Baldwin, Chair of the MPs' Committee on the Treasury, welcomed the appointment. She said: «The sooner the Bank can learn from the recent past, the better.»

Bank England Governor Andrew Bailey has faced criticism of the Bank's approach to inflation. Photo: REUTERS/Anna Gordon

Bank England Governor Andrew Bailey has faced criticism of the Bank's approach to inflation. Photo: REUTERS/Anna Gordon

A report by the House of Lords Economic Affairs Committee, which includes Lord King, a former bank governor, called quantitative easing a «dangerous addiction» and warned in 2021, before the recent price surge, that «if the Bank does not respond to the inflationary threat there will be enough early, it can be much harder to rein in later.”

Hugh Pill, chief economist at the Bank of England, told the Treasury committee in May that he was hard at work on improving forecasting.< /p>

“We acknowledge that our inflation forecasts were too low, and we are trying to understand why we made these mistakes, interpreting these mistakes in terms of behavior, and then assessing whether this behavior will continue in the future,” he told the deputies.

The Bank's Monetary Policy Committee, which includes Mr. Bailey and Mr. Pill, is set to meet again next week to set interest rates and release a new set of economic forecasts.Financial markets are expecting politicians to raise the benchmark rate to 5.25%, a level last seen in 2008.

Since leaving the Federal Reserve, Mr. Bernanke has served as a Fellow at the Brookings Institution and advised bond fund manager Pimco. In 2022, he received the Nobel Prize in Economics.

Свежие комментарии