After entering into a partnership agreement with Marks & Spencer in 2019, Ocado chief executive Tim Steiner described the £750 million deal as a «win-win» for both parties.

He stressed that M&S had taken an «incredibly smart risk» in partnering with the online grocer, insisting on the fact that “it’s not the same as going to a casino and putting in a chip.”

Five years later, it is unclear whether all parties are still on board, with recent tensions fueling speculation that M&S could move on. take full control of the Ocado Retail joint venture.

The prospect of Ocado freeing itself from its partnership with M&S could pave the way for a profitable future.

The company has always been a technology company, according to its founders business based on robotic warehouses. Having lost its retail division, new worlds lie ahead, including, according to analysts, a possible home in the United States.

A possible move across the Atlantic could help Ocado deliver on the promise once proclaimed by its technology arm Ocado. Solutions.

Investors have long hoped its technology division would accelerate growth, but Ocado's share price has fallen 66% over the past five years.

The company's sluggish valuation has led some market sources to propose radical changes to help unlock Ocado's full potential.

However, Ocado Retail boss Hannah Gibson stuck to the script during a media call on Tuesday: “We are all focused together, at M&S, Ocado Group, Ocado Retail, on improving the position of customers in growing this business and this is the conversation we are focused on «

There is no new news regarding the financial structure of the joint venture,» she added.

Under the terms of the agreement, from next year the financial statements of the online grocery store will be presented by M&S, and not Ocado Group, which posted first-quarter revenues of £645.3m after sales rose 10.6%. /p>

Some argue that the partnership is nearing its natural end, not least because of the looming legal battle caused by M&S's failure to make payments under the original deal.

M&S said the final tranche should not be paid , as the joint venture failed to achieve certain targets, leading Ocado to threaten to sue M&S over its position.

Meanwhile, M&S is calling for greater integration across the business, demanding more of its products be added to Ocado's website to improve performance.

Currently makes up just under 30% of Ocado Retail's range. M&S products, its highest ever.

Steiner has long argued that the joint venture represents the «best possible outcome» for both parties, with sources saying it helps showcase Ocado's warehouse technology. to the world.

However, a number of City analysts believe it is only a matter of time before M&S decides it wants more control.

“I expect the most likely ownership structure for Ocado Retail will be ownership of M&S,” says Clive Black, an analyst Shore Capital

Alternatively, Ocado may seek a new investor to take its stake in the business.

Then the question is what exactly. is happening with Ocado's technology arm, which sells robotic warehouse fulfillment technology to a dozen retailers around the world.

Its clients include US grocery giant Kroger, which uses Ocado's automated robots to transport groceries through giant warehouses.

Its clients include US grocery giant Kroger, which uses Ocado's automated robots to transport groceries through giant warehouses.

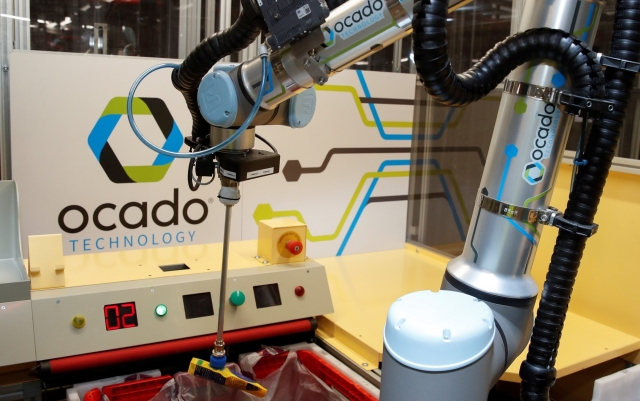

American grocery giant Kroger uses Ocado's automated robots to transport groceries through warehouses. Photo: REUTERS/Paul Childs

American grocery giant Kroger uses Ocado's automated robots to transport groceries through warehouses. Photo: REUTERS/Paul Childs

While its technology ambitions have long been of interest to shareholders, Ocado shares remain 80% lower than at their 2021 peak. It means the business is now worth just £4 billion, compared with £22 billion during the pandemic.

< p>Ocado's weak performance on the London Stock Exchange has reignited industry talk about its long-term future in the Square Mile.

Rumors last year of a potential takeover by Amazon quickly fizzled out, but that was enough to send Ocado shares up more than 40%.

Britten Ladd, a strategy consultant who previously worked at Amazon and advised Kroger on its partnership with Ocado, says businesses need to ask: «Why do we exist?»

Ladd says Ocado should consider ending its exclusive agreement with Kroger to grow more aggressively in the US , seeking deals outside of its main grocery store and targeting brands such as Target, H&M or Gap.

“I have been encouraging Ocado for many years to open a US office and appoint a US CEO,” he says.

He could also consider listing in the US market, raising funds from US investors or retail giants to finance a new promotion.

«There's no reason why someone like Ocado can't change their business model where they've been more aggressive in retail in the US overall,» he says. “I would strongly encourage Ocado to list in the US.

“This will certainly help Ocado unlock capital. However, the main thing is that Ocado articulates a strategy for using its platform.”

There may be other results. Ladd says he previously advised Kroger to buy Ocado outright and also suggested Ocado executives should merge with Instacart, the U.S. grocery delivery company.

However, insiders say Ocado remains fully committed to the Kroger deal and was keen to embed its technology deeply within its customers.

Shore Capital's Black says 'never say never' on US listing. «A number of UK stocks, particularly tech stocks, have moved into the US and achieved much higher multiples,» he says.

The US listing will see Ocado join a growing exodus from the City as blue chips seek more attractive valuations and greater access to cash.< /p>

While shareholders have long been unhappy with Ocado's valuation, Steiner, 54, faces more pressing challenges. .

Investors are threatening to revolt at the AGM later this month over his salary, which could be worth up to £15 million based on the share price.

Proxy Advisory group ISS has called on shareholders to vote against the deal, which it said «does not meet UK market standards and investor expectations as they stand.»

Despite Ocado's attempt to justify the deal, unhappy investors may have a point after the company said in February it did not expect profitability for five to six years.

It could be argued that the move from London to New York could speed up the process, although some believe investors are not You should hold your breath.

“The thing that really frustrates me about Ocado is that they are moving so damn slowly,” says Ladd.

Свежие комментарии