The crisis at Thames Water was revealed late on Wednesday as directors gathered for an emergency board meeting, some joining via video conference and others sat around a table in her London office.

At the center of their agenda was the upcoming £500 million cash injection from the company's investors, due before the end of the month.

< p>C However, before the Easter weekend a big problem arose: the shareholders decided to turn off the Thames.

Their move follows months of tense discussions with regulator Ofwat about Thames' 2025 spending plans. to 2030, implying 40% growth in customer accounts.

The company, which supplies 16 million households in London and the south east, says the increase is needed to balance its books, modernize creaking infrastructure and provide decent returns to shareholders.

In further queries raised Surprisingly, Thames also said it should be allowed to pay dividends to shareholders again — after seven years of abstention — and pay smaller fines for sewage leaks.

But Ofwat is having none of this agreed. The watchdog has suggested it will reject the demands in draft recommendations due to be published in the summer.

In response, on Thursday morning, as Thames Water's funding approached its deadline, investors publicly threw up their hands and declared the company «uninvestable.»

«We've done everything we can,» says one Thames backer . progress. “But there is a limit that has been reached.

“No responsible investor can continue to support a regulated business that is systematically prevented by the regulator from covering its costs.”

The crisis has raised fresh fears that businesses could collapse, requiring a taxpayer bailout that could amount to up to £5 billion.

Chancellor Jeremy Hunt on Thursday said the Treasury was monitoring the situation. However, Department for Environment, Food and Rural Affairs insiders stressed that ministers would not interfere in negotiations between the private company and the regulator.

The withdrawal of the cash injection was part of a £3.75 billion funding round. a package promised to the Thames until 2030 by the group of pension funds, infrastructure investors and foreign governments that collectively own it.

But to get the money, key conditions had to be met.

The most important thing , the UK's largest water supplier needed to win Ofwat approval for its 2025-2030 business plan.

A total of £18.7 billion is expected to be spent over five years, including £4.7 billion sterling for network modernization.

This would have been largely funded by a 39.6% increase in bills compared to the average of £436 per household. to £609.

But this is understood to have met stiff resistance from Ofwat, which has indicated in private discussions that the rise is too steep — and will effectively force consumers to pay the price for a huge Thames borrowing spree.

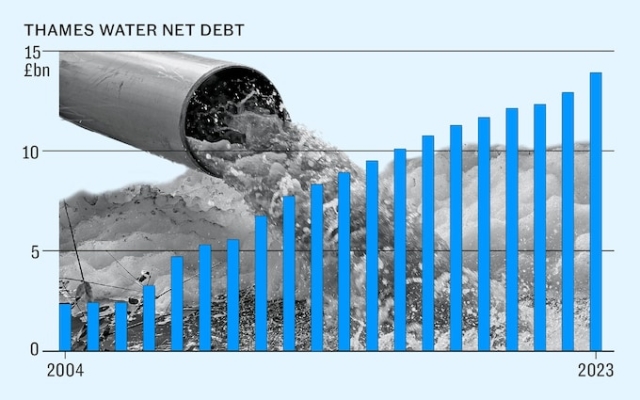

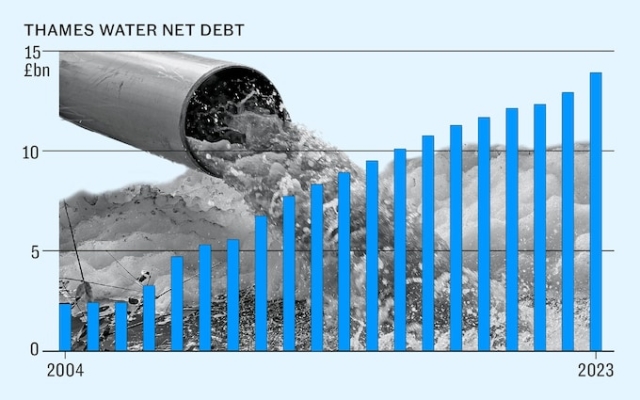

The entire Thames Group is in the red under a mountain of debt of almost £19 billion, of which operating company Thames Water Utilities Limited accounts for £13.9 billion. And while the company's financial difficulties have become more acute in recent months, the problems it faces may be linked to its former owner Macquarie.

When Macquarie bought Thames in 2005 from Germany's RWE, the water company's net debt was just £2.4 billion. But by the time Macquarie sold Thames to its existing shareholders just over a decade later, borrowing had risen to almost £11 billion.

This came after Macquarie also received almost £3 billion in in the form of dividends, for which it has since been subjected to sharp criticism. (The Australian investment giant has repeatedly defended its leadership role, pointing out that it has spent £12 billion on investment in the network.)

Regulators now fear that allowing Thames to simply raise bills sharply poses a moral hazard.

p>

A source close to Ofwat said British households should not be expected to foot the bill for past extravagance company, adding: “They are looking for very generous compensation. The regulator believes that “investment-like” cannot mean that clients pay for unsuccessful financial engineering — this is simply unacceptable.”

On Thursday, insiders also expressed suspicions about the timing of the announcement by Thames Water and its shareholders.

The March 31 funding deadline was self-imposed, the source said. They noted that Ofwat's draft decision was not due for at least two to three months, and Thames' finances today were no different from yesterday.

Ofwat chief David Black, meanwhile, more widely criticized the water industry for its history of priority of dividends over investments in pipes and other infrastructure.

“In some cases, companies increased their debt levels in order to pay dividends… This is wrong. They need to change that,” he said last year.

The regulator itself has come under fire in recent years for its laissez-faire approach to the industry, which campaigners say allowed suppliers to pollute rivers , while shareholders made huge profits. payments.

But ministers are now signaling their support for a firm decision: Michael Gove, the Leveling Up Secretary, calls the Thames a «disgrace» and a source close to Steve Barclay, the Environment Secretary, says Ovat was rights by standing up for households.

“We certainly don’t think customers will find it acceptable to ease regulation because of this company’s demands,” the source added.

“The public wants less sewage to flow into our waterways.”

It is unclear that the Thames would be any better off under a Labor government.

Sir Keir Starmer has ruled out any prospect of nationalization, which party insiders considered too costly and time-consuming. Instead, he vowed to crack down on the industry with even tougher regulation.

Feargal Sharkey, the former Undertones frontman turned outspoken critic of water companies, was among those on Thursday accusing Thames Water of various owners of «divorcing» the company.

Thames Water confirms this: shareholders are not ready to bail out the company.

Can TW survive the holiday weekend? Tick tock, tick tock, tick tock… 🤔

Not a penny of the public's money, you hear that @RishiSunak @10DowningStreet, not a dime of the public' money. pic.twitter.com/cFTxDYZlXh

— Feargal Sharkey (@Feargal_Sharkey) March 28, 2024

The company's nine investors include the University Pension Scheme, which manages university teachers' pension funds, the BT pension fund, the Canadian teachers' pension fund Omers, infrastructure investor Hermes and sovereign wealth funds linked to China and Abu Dhabi.

Thames has tried to attract more patient investors in recent years, but it has also faced additional pressure from rising interest rates, which have led to higher debt payments, as well as flooding caused by climate change and population growth.< /p>

Investors say Ofwat has persistently failed to fully consider these factors, leaving the company forced to cover shortfalls in care supplies.

Without permission to raise bills by 40%, the company says , faces a loss of £4bn. black hole in the period 2025-2030 — an amount they finally decided was too big to digest.

«After more than a year of negotiations with the regulator, Ofwat was not prepared to provide the necessary regulatory support for a business plan that will ultimately address the challenges facing Thames Water,» shareholders said in a joint statement on Thursday.

Thames executives say the company still has options. The company had about £2.4 billion of cash and leverage at the end of February — enough to last until May 2025.

But to survive further, it will have to raise more debt and convince its shareholders to do so. change their minds or find new backers.

However, all three options now appear to have little prospect as fund managers dump Thames' loan notes.

The bond linked to the entity in the Thames Byzantine structure fell on Thursday in price almost doubled to just 16 pence per pound.

The bills, due in 2026, were worth as much as 87 pence six months earlier.

Gordon Shannon, manager of bond fund TwentyFour Asset Management, says the collapse in bond prices raises «huge doubt» that Thames will be able to repay bondholders

“You don’t want to have a default on your books, so more people are capitulating,” he adds.

Despite this, on Thursday sources close to Ofwat and Thames Water's own bosses insisted they still believe the administration is a distant prospect.

«There is a chance that somewhere down the line you can achieve special administrative result, but there is still a lot of water that needs to be let under the bridge. » said Thames chief executive Chris Weston, using a seemingly unintentional pun.

If either side in the standoff miscalculates, households, not just investors, will ultimately pay the price.< /p> >

Свежие комментарии