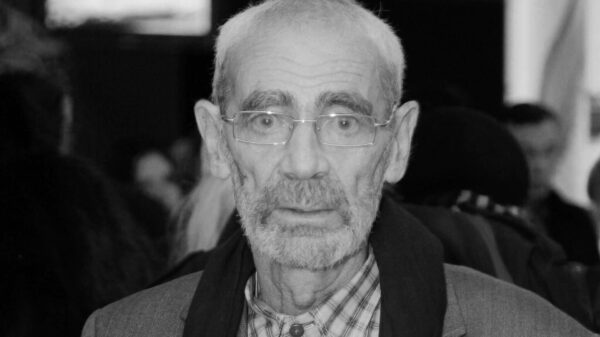

Lloyds chief executive Charlie Nunn hopes to kickstart growth Photo: Simon Dawson/Reuters

Lloyds chief executive Charlie Nunn hopes to kickstart growth Photo: Simon Dawson/Reuters

Lloyds cuts jobs in risk management after , which concluded that an overly cautious approach was holding back growth.

Roles are to be cut after a review by the bank concluded that internal risk structures were acting as «blockers» to change.

p>

Chief executive Charlie Nunn is seeking to reform Lloyds by cutting costs and boosting sales as the situation becomes increasingly difficult for British banks this year.

However, a staff survey first reported by the Financial Times found that two thirds Senior executives said the way Lloyds assesses risk is holding back Mr Nunn's plan for a shake-up.

The survey of all staff also found that less than 50% of those surveyed believed the bank encouraged «smart risk-taking».< /p>

Lloyds operates a self-proclaimed “three lines of defense” risk model, in which three separate levels of management address ineffective risks. financial risks such as regulatory compliance.

Local managers have primary responsibility for this, with additional oversight provided by two higher-level departments: Risk and Group Internal Audit.

The reshuffle will see 45 roles cut from these risk management teams, equivalent to around 1.5% of the 3,600 people who work in risk roles at Lloyds.

The job losses are the result of a wider reshuffle across the service Lloyds risk management and other parts of the business, announced in March. A total of approximately 175 positions will be eliminated.

This will be offset by the creation of 130 new positions specializing in risk management, resulting in a total of 45 fewer jobs.

The changes will help the bank «reset our approach to risk and control» and allow Lloyds to «move at a faster pace», according to an internal memo seen by the Financial Times.

Mr Nunn is accelerating the pace of change at the bank after as it laid out a restructuring plan in February 2022.

p>

It hopes to jumpstart growth by focusing on wealth management and insurance products for the wealthy, as well as core banking and savings products.

Mr Nunn is also looking to increase profits by cutting costs. As part of an overhaul last year, thousands of middle management jobs were at risk of being cut.

Like other banks, Lloyds expects to face more challenging conditions in the coming year, expecting interest rates to rise. will soon begin to fall. This will reduce the level of net interest income, Lloyds' main source of profit.

Lloyds is the UK's most valuable domestic bank and the country's largest mortgage lender through its Halifax brand.

A Lloyds spokesman said: “Making change doesn't just mean creating new roles and upskilling colleagues in certain areas of the business, but also the need to say goodbye to talented colleagues who have been part of the group's success in the past.

“Where unfortunately this is the case, we will do everything we can to support them in the recent announced changes. In this case, there are about 45 role cuts taking into account the new roles created.»

Свежие комментарии