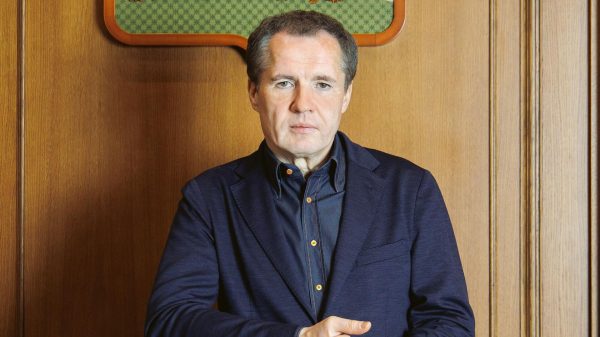

The Prime Minister's government's election promises will rest on privately financed debt. Photo: CHRISTOPHER FURLONG/POOL/AFP via Getty Images

The Prime Minister's government's election promises will rest on privately financed debt. Photo: CHRISTOPHER FURLONG/POOL/AFP via Getty Images

Britain is set to borrow a record £206 billion from private investors this year as Rishi Sunak begins piling up debt ahead of the general election.

Economists at Nomura predict the government will be forced to rely heavily on financial markets to fund borrowing this year and next as the Bank of England withdraws bond purchases under its quantitative easing (QE) program.

< p >George Buckley, an economist at Nomura, estimates that the private sector is asked to finance £206 billion of borrowing this year and £237 billion next year, a record high.

Mr Buckley said: «There will be more opportunities in the market [to buy] government securities in these two years than in the previous nine years [combined].»

However, experts warn that aggressive borrowing could lead to to higher interest rates as Labor and the Tories seek to win votes by promising tax cuts or spending increases.

Imogen Bahra, an analyst at NatWest Markets, said: «The extreme extreme.» The scenario is that the UK cannot finance itself through the capital market.

“It is more likely that this is simply a rise in gold yields as the clearing price for the market to absorb all this supply gets lower and lower. , and we will return to higher levels of yield across the curve.”

At the height of the pandemic, the government borrowed £435 billion over two years. But it was actually financed by the Bank of England, which stepped up quantitative easing to buy £450 billion worth of bonds.

The Bank currently sells some of these bonds to private investors such as pension funds, insurers, savers and banks, meaning the government is more dependent on the financial markets.

Paul Johnson, director of the Institute for Fiscal Studies, said both the Tories and Labor parties emphasized caution about borrowing and were «committed to at least a reasonable degree of fiscal common sense.»< /p>

However, he added that there was political pressure to spend more in areas such as the NHS, prisons, defense and childcare, all of which could lead to more borrowing, creating uncertainty for markets.

The wall of debt facing markets means investors are sensitive. politicians' spending plans, raising the possibility that they could require the Treasury to borrow more, putting further strain on government finances.

Higher borrowing costs already mean the government is spending more money on interest on debt. costing it more than £100bn a year according to official forecasts.

Jim Leaviss, bond markets expert at M&G Investments, said markets were particularly nervous following Liz Truss's disastrous mini-budget in 2022 , which provoked a sharp increase in borrowing costs.

He said: “The scars in the market's memory of what happened then will be very, very interesting to investors. in [government] spending plans.

“This ties the hands of both future governments in terms of easing fiscal policy ahead of the expected general election in November.”

Vivek Paul, chief investment strategist at BlackRock in the UK, said any costly election promises could frustrate investors.

“As UK inflation falls and we move closer to the general election date, the UK's major political parties may be worried there is a greater temptation to promise looser fiscal policy—the more often that happens, the greater the likelihood of a return of bond vigilantes,” he told Bloomberg News.

Mohamed El-Erian, Allianz's chief economic adviser, said he expected «a year of yield volatility» with a «tug of war» between heavy borrowing, which is pushing interest rates higher, and weak economic growth, which is keeping borrowing costs low.

Michael Eakins, chief investment officer at Phoenix Savings and Pensions Group, added: “Across the G3, namely the US, eurozone and UK, 2024 is likely to see record levels of debt issuance.

“When you're in a world where there's a significant increase in debt issuance, it does point to higher gold yields.”

< p>A Treasury insider said debt issuance is facing market, has shown the need to keep borrowing under control.

“The best way to reduce gold yields is to tightly control government finances, and that is what we are doing. you are studying. As the Chancellor has said, we will only cut taxes if it is affordable and responsible,” the source said.

Свежие комментарии