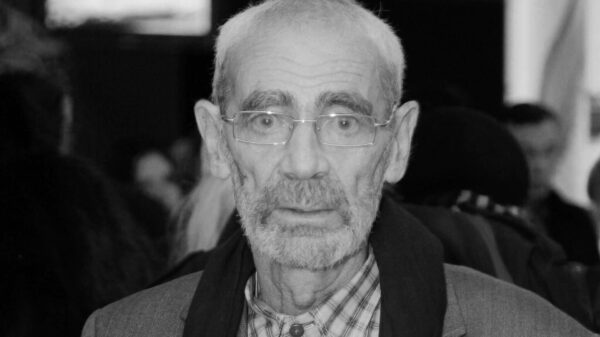

Andy Briggs says the UK needs to prepare for the inevitable consequences of demographic change. Photo: Holly Adams/Bloomberg

Andy Briggs says the UK needs to prepare for the inevitable consequences of demographic change. Photo: Holly Adams/Bloomberg

Pensioners are at risk of receiving less state pension and are forced to wait longer for payments as the UK system «cannot cope» with an aging population, the chief executive of life insurer Phoenix Group has said.

Andy Briggs warned the burden on state pensions would soon become unsustainable without significant reform as he urged people to save money for their own pension pots.

The Phoenix boss, who oversees the company's 12 million customers and £259 billion in assets, told The Telegraph: «The state pension simply cannot cope with what it was originally designed to do.»

«Essentially , state pensions will have to be paid out later and at a lower level, and people will have to provide more personal security.”

He said the system was being strained by seismic demographic changes. .

When the state pension was first introduced in 1948, men retired at 65 and women at 60.

“At that stage, a man's life expectancy was 67,” he said. . “So the whole thing was designed with the expectation that life expectancy after retirement would be two years.”

Men today retire at 67, and then their life expectancy will be 85 years, which means that the demand for the state pension is growing more and more.

The situation will get worse. According to the World Health Organization, by 2050 the number of people over 60 worldwide will double. The number of people over 80 worldwide will triple.

“The UK figures will not be significantly different from this,” Briggs said. “Of course, we are not going to raise the state pension age by seven or eight years.

“There will therefore be pressure on the state pension as a result. Either that, or tax rates for working people will have to rise significantly.»

Research from the International Longevity Center shows that the UK will need to raise the state pension age to 71 by 2050 to maintain the number of workers per pensioner.< /p>

But that won't be enough to solve the system's accessibility problem, Mr. Briggs said.

Poor health, disability and caring responsibilities often result in people leaving the workforce several years before reaching retirement age.

These people, who have disproportionately low earnings, will still need support from state side.

>»There is a real need to examine the role played by the state pension, alongside other policies such as auto-enrolment and working-age benefits, to develop a system that truly addresses the reality of inequalities in work, health and savings,» Mr said Briggs.

The threat to the state pension comes on top of the fact that the vast majority of people are not saving enough for their private pensions, Mr Briggs warned.

Just as the UK adjusts to a larger older population, it is also undergoing a transition from defined benefit pensions, where employers pay them based on a worker's final salary, to defined contributions, where the size of a person's pension fund depends on the amount they pay.

Many people retiring today will be on large defined benefit pensions, Mr Briggs said, meaning many are in «reasonable shape».

However, that is about to change.

“People will soon be retiring on defined contribution pensions,” he said.

“Only one in seven of these savers makes enough for a decent standard of living without seeing a significant decline in their pre-retirement income. This is very widespread across all sectors.”

This means that, according to Phoenix Insights, between 15 and 17 million people are likely not saving enough money to retire when they want, with the money they want. income.

Mr Briggs blames misunderstandings between generations.

< p>«They've seen that their parents' generation is comfortable with their state pensions and defined benefit pensions, so they think they'll be fine,» he said. “They don't understand reality. Everything was taken care of, but this is no longer the case.”

However, the prospects are much better than they could be.

In 2012, then-chancellor George Osborne introduced auto-enrolment, which meant all employers were required to provide workplace pensions.

It was very successful, Mr Briggs said: “We used to have 10 million people saving for their retirement in the UK. Now we have 20 million.”

But there are two areas where the system fails. “Firstly, this does not yet apply to the self-employed.”

This means that a total of 5 million people remain outside the system.

The second problem is that the minimum contribution of 8% of salary is too low, Mr. Briggs said.

The UK average is around 10%, while the Canadian average is double that at 20%.

Mr Briggs is calling for the minimum contribution to be raised to 12%.

The Government also needs to make pension advice more accessible, Mr Briggs said.

But the solution isn't just about saving more. «We need to radically change the way we think about working later in life,» said Mr Briggs, who is also a government advocate for older workers.

People need to think about working longer, — he said. argues that most people do not understand how much they will need to retire with.

The way pensions are invested must change to deliver better returns, argues Mr Briggs. Photo: Holly Adams/Bloomberg

The way pensions are invested must change to deliver better returns, argues Mr Briggs. Photo: Holly Adams/Bloomberg

«My message to The Telegraph readers is that they need to take control of their destiny on this issue,» he said. “If you're over 50 and not working, at least make sure you really understand the trajectory you're on.”

As well as increasing the public pension burden, the demographic pressures of an aging population mean that more and more older workers are leaving the workforce.

One in five people over 50 years old has primary caring responsibilities for an elderly relative. At the same time, many have to take care of their grandchildren. If people over 50 leave work to help their families, they are unlikely to return to work.

Mr Briggs said employers need to make it easier for them to stay in work by offering them the option to reduce their hours or change opening hours.

Currently, there is a large gap between what these people need and what is offered to them.

According to Phoenix Insights, 59% of people aged 50 said employers are leaving older workers behind.

Mr Briggs says businesses are missing out on a source of experienced workers who could play a crucial role in boosting the UK economy .

“I’m talking to the chancellor about this in detail,” he said. “Many companies I speak to are struggling to get the skills and opportunities they need, and we have half a million unemployed over-50s who want to work. Let's put those two things together.»

The way our pensions are invested also needs to change to provide better returns for savers, Mr Briggs said.

Over the past decade, defined contribution savers in the UK have received a net return of 4%. In Canada and Australia, yields were 5.2% and 5.5%, respectively. “Essentially, that's a third more income in retirement if you're Canadian or Australian, compared to the UK.”

The key is to move more of Britain's pension savings into so-called productive assets, namely things like private equity and venture capital. Currently, only 9% of UK pension assets are concentrated in such investments, compared with 23% in Canada and Australia.

Under Chancellor Jeremy Hunt's mansion deal last summer, Phoenix committed to investing 5% of its pension assets in private assets such as early-stage venture capital.

Britain also needs to do more to attract foreign investors to the UK , Mr. Briggs said, but that would depend on stability.

“When I talk to investors in the US, they say: “I like the sound of your company, Andy, but I’m a little worried about the situation in the UK.” You've done Brexit. And then there was all this instability with the Truss mini-budget.” Investors have long memories.»

Свежие комментарии