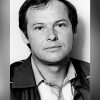

Jeremy Hunt's further tax cuts will make it harder for Labor to balance the balance. Photo: JUSTIN TULLIS/AFP via Getty Images

Jeremy Hunt's further tax cuts will make it harder for Labor to balance the balance. Photo: JUSTIN TULLIS/AFP via Getty Images

The Institute for Fiscal Studies (IFS) says Jeremy Hunt is well positioned to cut National Insurance contributions by a further 2p in a move that could potentially boost working people ahead of the election.

The chancellor only has an extra £12 billion to meet his rolling five-year borrowing target because the UK has now started a new tax year, meaning its deadline is automatically pushed back by 12 months, the think tank said. /p>

The additional employee tax cut will come on top of the cuts announced in the Autumn Statement in November and the Budget in March. Mr Hunt said he would eventually like to abolish national insurance.

Any further tax cuts will make it even harder for Labor to balance the balance sheet if it wins the election later this year. Rachel Reeves, the shadow chancellor, has previously said the party will not reverse cuts to national insurance.

However, Helen Miller, deputy director of the IFS, said Mr Hunt should not be tempted to use the extra funds. £12bn for tax cuts, calling the sudden addition of extra reserves «a quirk of a poorly designed fiscal rule».

She said: “This is not a sensible basis for further tax cuts ahead of the election. And this should not distract from the serious financial challenges facing Britain and the smorgasbord of complex tax and spending options awaiting the Chancellor after the election.

“The decisions of the next government will determine the size and role of the state; distribution of resources among different households, generations and regions; and the long-term sustainability of public finances are issues that deserve attention and discussion.”

According to the IFS, the Chancellor will face a projected budget deficit of £40 billion in 2028-29 after the general election, even assuming taxes rise (including duty on fuel, which has been frozen every year since 2011) and that the government will cut costs. investment expenses.

The planned tax rises include a freeze on personal benefit and income tax thresholds, which is due to remain in place until March 2028. The IFS calls this a «significant planned increase in tax».

p>

It added: «Unfreezing the thresholds would reduce revenue by £11 billion in 2029-30.»

National Insurance cuts have already seen the overall rate fall from 12% to 8%, which Mr Hunt said would collectively save the average worker earning £35,400 more than £900 a year.< /p>

In his Budget speech, the Chancellor said tax cuts would also encourage more people to work, as well as encourage those who work to put in more hours.

At the time he said: “ Combined with the autumn cuts, the cut to our national insurance will mean 200,000 more jobs, meaning one in five vacancies will be filled and an increase of 0.4.” percent to GDP and 0.4 percent to GDP per capita.»

Свежие комментарии