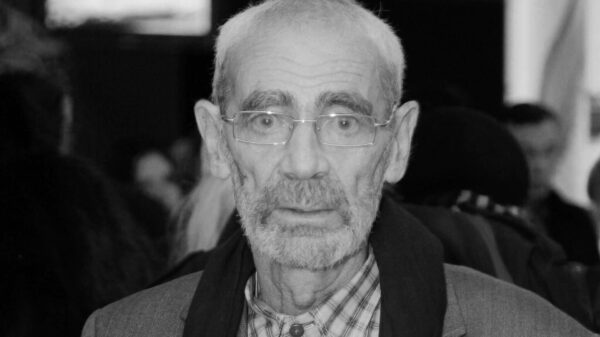

George Osborne told The Telegraph that quantitative easing «seemed sensible at the time»; Photo: DANIEL LILL-OLIVAS/AFP/Getty Images

George Osborne told The Telegraph that quantitative easing «seemed sensible at the time»; Photo: DANIEL LILL-OLIVAS/AFP/Getty Images

George Osborne insists paper money, which would cost taxpayers £100 billion, seemed «reasonable» at the time.

The former chancellor said quantitative easing, in which the Bank of England committed £895 billion to buy bonds, «was the necessary policy to lift us out of financial collapse and contributed to the fastest recovery of any G7 economy.»

< p >He added that it was “not my job” to monitor the ongoing status of the scheme, which is costing the Treasury tens of billions of pounds due to an agreement with the Bank that losses should be borne by taxpayers.

>

The policy has begun during the financial crisis: it lowered the government's borrowing costs, injected liquidity into financial markets and initially generated profits for the Bank.

In 2012, Osborne transferred profits from the scheme to the Treasury. , lowering the Treasury's borrowing requirements but agreeing as part of the deal to also bear the brunt of any future losses.

However, higher interest rates and lower bond prices mean the Bank is now losing money. on the diagram.

As a result, the Treasury transferred £44 billion to the Bank last year to cover losses. The Office for Budget Responsibility (OBR) expects the total net cost to the government to exceed £100 billion.

Osborne said quantitative easing had been vital since the financial crisis.

Asked about the losses incurred by the scheme, he said: «It was sensible at the time and remains… it was a necessary policy to get us out of financial collapse and would contribute to the speedy recovery of any G7 economy.» /p>

“It was all part of a plan that convinced the world that Britain was at it.

“The Treasury and Parliament at that time assessed all possible scenarios. Of course, there were benefits for the Treasury then.

“I can't talk about the current situation — it's no longer my responsibility.”

Conservative MPs are demanding it. current Chancellor Jeremy Hunt is re-evaluating the system and forcing the Bank of England to stop selling bonds at a loss.

Greg Smith, chairman of Conservative Way Forward, said: «It is completely incomprehensible why the Bank would choose to sell billions of pounds worth of bonds a year into the market, incurring larger losses than they would have incurred if they had simply held them to maturity.» .

“The Chancellor is not powerless to stop this. The Treasury is the main guarantor — in fact, the Bank of England insisted on this. The Bank of England considers itself in this respect merely an agent of the Treasury. Therefore, the Chancellor can influence when these bonds are sold.»

Danny Kruger, MP for the Treasury Select Committee, said Hunt should intervene.

“Because the Treasury — the taxpayer — has committed to guaranteeing these losses, the Chancellor should have influence over when these bonds are sold. sold. There is no point in creating such huge losses when those losses could be minimized if they were held until maturity,” he said.

The costs come at the worst possible time for Hunt, who is trying to cut taxes, increase defense spending, prop up the National Health Service and meet his borrowing targets.

His goal is to reduce the percentage share of the national debt. GDP in five years. The OBR estimates it is set to do so with just £8.9bn in reserve.

The scale of the losses from QE is very sensitive to the development of interest rates in the coming years, which means that the Chancellor will be able to achieve what he wants. this goal is vulnerable to minor changes in financial markets.

This is also a threat to the Labor Party. The party has promised good funding if it wins the upcoming general elections. However, like Hunt, he finds himself vulnerable to the vagaries of financial markets, which could add or reduce the cost of QE by tens of billions of pounds.

To understand how a scheme designed to keep borrowing costs low ended up being ineffective. is so expensive, you need to remember 2009, when QE was first used in the UK.

During the financial crisis, the Bank of England cut interest rates from 5.75% to 0.5%. But this was not enough, and officials, led at the time by Mervyn King, wanted to do more.

Inspiring the US Federal Reserve, the Bank of England agreed with Alistair Darling, then Chancellor. that he would launch a program of quantitative easing — money creation and bond purchases — to weaken financial markets and further reduce borrowing costs.

Darling said the Treasury would reimburse the Bank for any losses under the asset purchase facility (APF), which was seen as a radical decision.

Officials called it “unconventional policy.” It was colloquially described as the «nuclear option».

Darling authorized purchases worth up to £150 billion. “In these extremely uncertain times, it makes sense to stimulate the economy through a variety of channels,” he said.

These funds were quickly used up, so he signed more. By the end of the year, the quantitative easing program had reached £200 billion.

This increase in scale was a sign of things to come.

Initially seen as a short-term emergency response, it became a permanent tool of monetary policy under the leadership of Mark Carney and then Andrew Bailey at the Bank. Successive Chancellors have signed these measures and supported the expansion of QE, including Osborne, Philip Hammond and Rishi Sunak.

When it became clear that QE was becoming permanent, an opportunity arose.

In 2012, Osborne, seeking to reduce the deficit, noticed a giant pile of money accumulated in the Bank of England.

The bonds he bought worth £375 billion were generating significant income by the end of that year.

The government gilded the purchased interest into the treasury of the NPF. The bank only paid a base rate of 0.5% on the money it created to buy it. The difference between the two was profit, and the Chancellor wanted it to be applied to the public finances.

“As the scale and likely duration of the scheme has increased significantly since its inception, it makes sense to normalize cash management. arrangements,” Osborne wrote to King in 2012.

“Keeping large amounts of cash in a non-state pension fund is ineffective.”

George Osborne wrote to Mervyn King in 2012. to say that leaving cash in the Bank's asset purchase vehicle was «ineffective»; Photo: Alastair Grant — WPA Pool/Getty Images

George Osborne wrote to Mervyn King in 2012. to say that leaving cash in the Bank's asset purchase vehicle was «ineffective»; Photo: Alastair Grant — WPA Pool/Getty Images

The bank began paying out cash every quarter, and by the time Osborne left No. 11, more than £65 billion had been transferred to the Treasury.

The possibility of future losses was acknowledged – “at some stage it is likely that cash flows from the NPF to HM Treasury will have to be reversed,” Osborne wrote – but they did not cause concern. The Treasury could recoup the costs later.

The cash withdrawal would not affect those final losses, but it did affect borrowing terms, the OBR said, holding them down in the short term and rising again. whenever these losses materialize.

Eight years later, the pandemic has put quantitative easing on steroids. Threadneedle Street cut its base rate to 0.1% and quickly bought £200 billion of bonds in Andrew Bailey's first week as governor.

“I am prepared to take whatever further action is necessary to support economy through the economic crisis,” wrote Sunak, who had just taken over as chancellor, extending the compensation.

Quantitative easing increased again and again, peaking at £895 billion, and by the end of 2022 the Bank had paid out compensation. Under Osborne's scheme, the Treasury made a profit of £123.9 billion.

But by this point interest rates had begun to rise, and the Bank began to sell some of its bonds. When interest rates rise, bond prices fall, so he sold the securities for less than he paid for them.

Suddenly the Bank suffered losses. Because the company's profits went to the Treasury, it did not have a significant cash reserve and had to call on the government to bail out.

OBR expects the Treasury will have to funnel up to £10 billion into Threadneedle Street for the foreseeable future

That net profit has now been reduced to around £75 billion – if Osborne had not taken the cash, Hunt would not be paying the Bank today.

The OBR forecasts a net loss of more than £100bn by mid-2032, but this figure could be up to £50bn higher or lower depending on how interest rates move.

The bank argues that its job is not to focus on costs: it sets policies aimed at achieving an inflation target and, in addition, argues that quantitative easing stimulated the economy and thereby helped government finances, despite the loss of bond cash.

“The fiscal implications of QE and QT are reflected not only in the cash flows between APF and HMT, but also in the wider impact of policy on financial conditions and the economy,” the Bank of England said in response to questions from the Treasury Select Committee.

QE has «lowered borrowing costs, lowered unemployment, supported the economy and helped stem deflationary pressures at various stages over the past 15 years,» it said.

The Treasury says it cannot intervene in monetary policy policy without risking worsening the impact on the economy.

“The separation of fiscal and monetary policy is a key feature of the UK's economic structure and is essential for the effective conduct of monetary policy. » the spokesman said.

«That's why it is vital that the government guarantees the Bank of England's asset purchases so it can achieve its monetary policy targets, including returning inflation to 2%.»

Свежие комментарии