The UK stock exchange fell further behind its European peers after the resumption of new listings on the continent put London in shadow < /p>

The recovery in initial public offerings (IPOs) across Europe saw almost €5bn (£4.3bn) in new listings in the first quarter, but London's contribution was just over 300 million euros of this amount. PwC data

Europe's IPO boom will do little to allay fears that London's once-dominant stock market is in trouble as its float famine continues.

German, Swiss and Greek stock exchanges outperformed London as IPO freeze prompted by dismal economic data and high inflation, began to thaw.

The blockbuster listing of skin care brand Galderma on the Swiss SIX exchange, raising 2 billion euros.

The German exchange, long seen as the London Exchange's main European rival, also attracted two major new debuts.

Renk, a German tank engine maker, raised €450 million, while German perfume retailer Douglas raised €890 million after how its owner CVC Capital cashed out. Athens also saw the listing of the city's Eleftherios Venizelos International Airport.

Thanks to this blockbuster, London remained in the shadows, and the city's best offer was the Kazakh airline Air Astana with a price of 324 million euros.

PwC UK Capital Markets partner Vernie Manikavasagar said domestic companies had led the continental boom and London remained the choice for international organizations.

«London continues to be a market that people are looking at outside their home market,» she said.

“The IPOs you've seen in Europe are domestic IPOs in the domestic market. Air Astana shows that London is still the market Europeans look to when looking to secure an international listing outside their home market.»

She added that a renaissance on the continent could encourage UK boards consider the possibility of placing shares.

“People are now seeing markets returning to normal, but companies are just now starting to think through their processes, which means they won’t be able to succeed until the end of the year.”

«We will also have some significant changes (in London) that people are watching, and that hasn't happened to the same extent in European markets.»

Improving economic data has encouraged more companies to tap into the stock market, which makes The lack of a London float is even more puzzling.

High stock market volatility discourages companies from floating due to fears that an IPO will fail, but this has eased recently.

Lower inflation and more predictable interest rate expectations have reduced volatility, opening the door to more new listings.

One City broker blamed the drought on a lack of demand from UK fund managers and reported the current level of IPOs. the London market was «dismal».

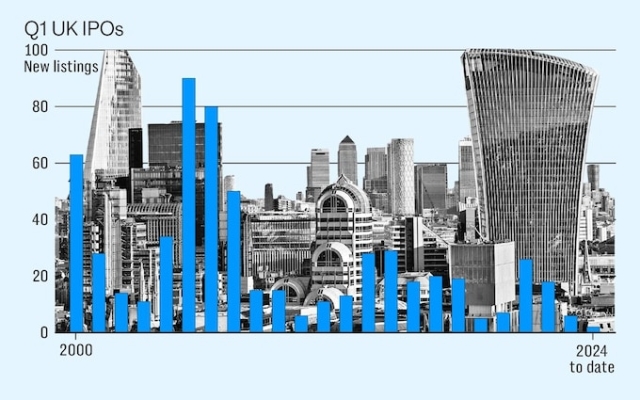

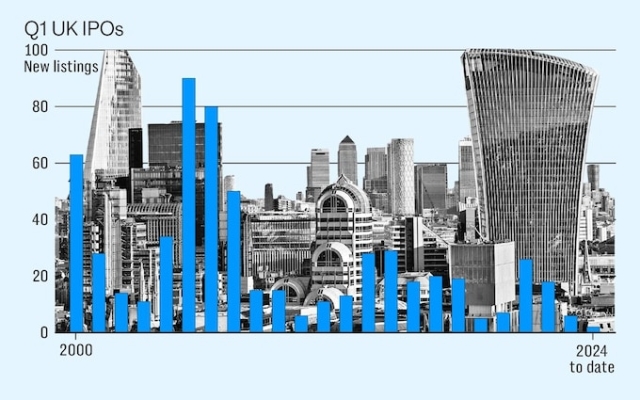

According to Dealogic, there were just two new listings on the main London market last quarter, the worst quarter in terms of volume since the data firm began collecting data in 1995.

“There is no shortage of companies that could go public,” the broker said.

“You will need it only takes one or two major listings to start the domino falling. The problem is demand. Good companies won't come because [fund managers] won't support them.

«They won't come to market until the demand is fixed.»

Chancellor Jeremy Hunt has proposed a series of reforms to try to tackle the problem.

The Edinburgh reforms, a package of measures to remove onerous restrictions on company listings, were accompanied by supply-side changes such as the UK Isa to try to lift the gloom hanging over over British shares.

Investment in UK shares has been in steady decline for several years.

Numis estimates there was another net outflow from UK equity funds of around £2.6 billion in March, bringing the total for the year to £4.6 billion.

This means that 2024 will be another year of net outflows, the ninth year in a row that more money has flowed out of UK equity funds than has been added since 2015.

The less money flowing into UK equities, the lower the valuations. which ultimately makes the UK market a less attractive place to list a company.

The gap in UK valuations has become even sharper due to the stunning success of the Nasdaq, where the Magnificent Seven — Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia and Tesla — have made London even more unattractive.

However, City fund manager Gervais Williams, who heads up the equities department at Premier Miton, said a string of failed IPOs had left many skeptical about the quality of new listings.

«We've had a series of pretty crappy IPOs,» he said.

«Whatever the reason, it's not working as well as it could, especially since we're supposedly pricing IPOs highly given there aren't that many of them.»< /p>

Large London market IPOs such as CAB Payments have wiped out many fund managers. The stock, which was seen as a possible catalyst for a relisting last year, has fallen 60%.

Looking ahead, London's prospects for attracting large IPOs in the future look uncertain.

A possible listing of Unilever's ice cream division could be a candidate for a listing in London, but CEO Hein Schumacher recently said Amsterdam is leading the way for any listing.

CVC, the private equity firm behind the Six Nations rugby tournament, is also set to list in Amsterdam rather than London, which would be another major blow for the capital.

Flutter Entertainment is set to change its primary listing to New York. from London following similar moves by companies including TUI, which moved its main listing to Frankfurt.

A host of other candidates could follow in parallel.

Deutsche Bank analysts said last week that FTSE 100 commodities trading giant Glencore could be the next company to move out of London and will move to other countries. to New York.

The group was already planning to spin off its coal division and list it in New York rather than London, prompting speculation that the entire business could be sourced from London.

However, Mr Williams said there was still demand among fund managers for good companies, citing the possible flotation of the Raspberry Pi as a possible catalyst for more trouble.

“I don’t think the market is completely closed at all,” he said. “Obviously you have to have good issues and I think if you have two or three good issues the market will open up again.”

Свежие комментарии