The last baby boomer turns 60 this year. Many people born between 1946 and 1964 have already retired, and millions more will follow in the coming years, with the number of people reaching state pension age forecast to reach a record 800,000 for the first time in 2028. By then, the earliest a person can claim a state pension will be 67, up from 66 today.

Rising life expectancy meant that for decades raising the pension age was the silver bullet that helped defuse the British economy. demographic time bomb. But not for long.

So far, raising age limits has allowed baby boomers to work, fueling a jobs recovery from the financial crisis and keeping the economy afloat.

This meant that politicians could think of pensions as a thing of the future. the problem is a long-term problem of slowly changing demographics, which can always be left to a future government.

But that time bomb is still ticking. Falling birth rates and life expectancy in Britain mean the country is about to explode amid a huge wave of retirements.

The Telegraph looks at the future of the state pension in a three-part series, focusing on its implications for work, retirement and living standards across generations.

In this first part, we look at whether the Government can continue to add up the amounts when the number of retirees is expected to grow from 12 million today to 17 million by 2070.

Challenges Ahead

The working-age population is expected to increase by just over 1 million to 44 million over this period . .

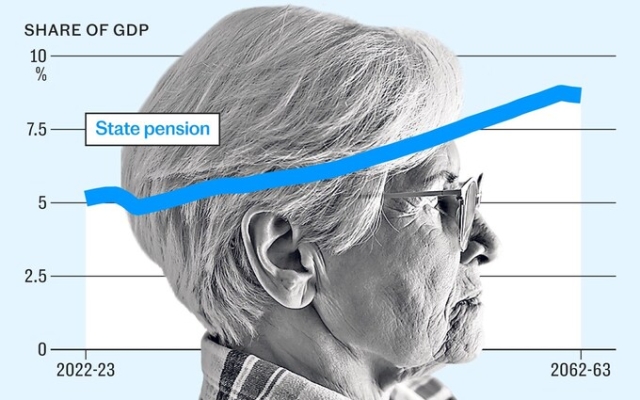

Already, £1 in every £8 of government spending goes towards the state pension. Fast forward 50 years and that figure is roughly equivalent to £1 for every £6.

A wave of boomer retirees this decade is expected to push up pension bills dramatically. While raising the state pension age to 67 by 2028 will stem rising costs, the Office for Budget Responsibility (OBR) forecasts total state pension spending in 2027-28 will be £23 billion higher than in the early 2020s. . This leap will happen not in five decades, but in five years.

Sir Charlie Bean, a former OBR official, says the world has taken the global peace dividend and the era of cheap money for granted, spending extra money with with enthusiasm. , which now strikes again.

“If you go back about 50 years, about a quarter of [government] spending was on health and welfare, including pensions. That figure has roughly doubled, largely due to demographic forces (aging) as well as the nature of technological change in the healthcare sector,” he says, noting that medical innovation is often expensive.

“Three things made room for this. First, a decrease in public investment; second, the decline in defense spending [which was accompanied by] Cold War dividends; and thirdly, a reduction in the contribution of interest on debts.”

Suddenly the situation changed, with serious consequences for the spending of the next Parliament at a time when money was already very tight.

The OBR believes spending on state pensions will rise from 5.1% of GDP this year – or around £130 billion in today's money – to 8.6% of GDP in 2073, or around £230 billion. . An older population also means greater demand for health care spending, which will rise from 8.2% of GDP to 15% of GDP this year.

While a decline in the number of young people will reduce spending on schools during this period, a surge in spending on older people will increase the size of the state's economy to more than half, up from 33% before the pandemic and about 38% by 2020. end of the decade.

Governments have two options if they want to limit public pension spending in the future. Make people wait longer to claim it, or make it less generous.

Life is too short

The question of when the state pension age should rise from 67 to 68 has already been the subject of two independent reviews.

p>

John Cridland, author of the first report in 2017, suggested that number should rise to 68 between 2037 and 2039. Baroness Neville-Rolfe, author of the second, said that as a rule of thumb people should spend about a third of their income. after an adult life in retirement, he is not expected to reach age 68 until 2041-2043.

But falling life expectancy has put a damper on the job, forcing Jeremy Hunt to delay a decision on when to next raise his pension age for the second time.

Advances in health care and improved working conditions have led to a four-decade increase in life expectancy. But the pace of growth has slowed, and not only because of the pandemic.

Life expectancy growth has been slowing since 2011, and pandemic deaths in 2020 and 2021 have reversed progress. According to the Office for National Statistics (ONS), life expectancy is now roughly back to where it was a decade ago.

Life expectancy at birth in the UK is currently estimated at 78.6 years for men and women, according to the ONS. 82.6 years for women. This is 38 weeks less for men and 23 weeks less for women compared to 2017-2019.

Cridland, who wrote the first report for the government, said: “I think there is quite a lot of evidence that the continued increase in life expectancy is reaching its peak. And this is covered by the pandemic, but in fact there were already signs. If this is the case, then it could be argued that the trajectory of further tightening of state pensions, both in age and support, may become more muted. My instinct is that the days of significant increases in life expectancy are becoming a thing of the past.”

In 2020, for every 100 people of working age there were about 30 pensioners. That number of pensioners has already risen to almost 32 and will reach 35 by the end of the decade – the period during which financial decisions will be made in next week's budget.

Making people wait longer to access their pension may seem obvious, but it also risks widening the inequality gap. A recent report from the Longevity Center suggests that people may have to work until they are 71 before they start receiving the state pension to maintain the number of workers per pensioner.

If this is the case , then the average Newton Heath and Moston resident in Manchester will die without getting it. Life expectancy here is just 70.2 years, compared to 85.6 years in nearby Deansgate.

Healthy life expectancy also varies greatly depending on where you were born. A man in Rutland can live 75 years in poor health, while in Blackpool the figure is just 54.

Even this rapidly deteriorating picture doesn't tell us the whole story.

Looking at the number of people of working age is one thing. Another thing is to look at how many people actually work and pay the taxes needed to fund the state pension.

The number of economically inactive working-age people is growing, reaching 9.3 million at last count. This is equivalent to 21.9% of all people aged 16 to 64.

Lord Turnbull, the former permanent Chancellor of the Exchequer and Cabinet Secretary, says the underlying trends that have helped in recent decades are no longer enough to maintain healthy levels of dependency.

“Immigration helps restore the balance, but now we are going through a stage where we find out where all the workers have gone? There has been a huge increase in inactivity,” he says.

“Overall, activity has increased as more women entered the labor market, but inactivity has emerged during the pandemic and, almost uniquely among peer countries, , it did not return to its trend level, but remained at a high level.”

In particular, he worries that “we are the sickest country in Europe,” which is pushing people out of the workforce and leaving the government coffers that cover health care costs without tax revenue.

Cridland proposes providing a government pension will remain fair and will require difficult choices.

He says that over the next decade, if the UK wants to “start implementing a plan to limit rising costs without having to plunder the health budget, or plunder the education budget, or raise taxes, the next logical step you would take is to raise the retirement age, by in my opinion, will be to remove the triple lock.”

& #39;I spent a week living a little more than on a state pension – it wasn't such a great life' Read more Lock and load

The policy, introduced at the start of the last decade, ensures that pensioner payments will rise by a maximum of 2.5%, based on inflation or income growth, whichever is higher.

It is understood that the Conservative Party will include it is a commitment to its election manifesto.

A Tory source said: “The triple lock is a Conservative Party invention, it has been in every Conservative Party manifesto since we introduced it, and we will take it up again.” “.

Labor has signaled it will do the same and has called on the Prime Minister to commit to that commitment.

Rachel Reeves, the shadow chancellor, says: “The difference between retirement and working age is when You are retired, it is very difficult to increase your income. So I think stability and knowing that your income is protected is very important.

“We have always supported the triple lock.”

A Labor Party spokesman added: “The Labor Party will always be committed to ensuring that working people receive a fair, decent pension and financial security in retirement.”

“The Rishi Sunak Government has previously broken its promise to pensioners and now needs make clear our intention to maintain the triple lock so that pensioners' incomes do not lag behind the level necessary to provide them with a decent standard of living.”

Pensions minister Paul Maynard describes the state pension as a safety net for millions of people.

“I want the state pension to remain the basis of post-retirement income for future generations so that it is sustainable and fair,” he says .

“That’s why the government introduced a triple lockdown. , and since 2011, we have lifted 200,000 seniors out of poverty. With the full rate of the new state pension set to rise to £11,500 in April, this is vital extra money for our hard-working pensioners who rely solely on this income.

“We are taking long-term decisions to build a brighter a future for millions that will benefit retirees today and tomorrow.”

But not everyone is a fan of the triple lock. Peter Lilley, the former work and pensions secretary, describes it as “absurdly generous and unsustainable in the long term.”

He adds: “Why should pensioners get a raise when neither prices nor wages are rising.” rise, it's absurd.”

Lord Turnbull says the triple lock is “foolish but terribly difficult to get rid of.”

“When we face a shock, a production shock or a price shock , you suddenly find that you have significantly increased your pensions,” he adds.

“But it wasn’t a deliberate decision, it just happened. This is a very stupid way to do it.”

The government intends to review the state pension age again during the first two years of the next parliament.

Sir Steve Webb, the pensions minister who helped introduce the policy, says it is time to look at public spending as a whole. to find solutions to keep state pensions on a sustainable path.

“There are many things you can do to make the state pension system more accessible, beyond simply raising the retirement age. One is to get more working-age people economically active,” he says.

The OBR estimates that the total annual tax loss from increased health-related inactivity and ill-health at work is likely to be almost £9 billion a year. That would be more than enough to cut income tax by 1p and still pay for the triple lock.

“That's a much better thing to focus on than just constantly raising the pension age,” says Sir Steve.

“The risk is that we think that the solution to the problem of state pension affordability lies solely in the state pension system, but this is not the case.”

There may be more than one solution to the problem. But the state pension time bomb is still working, and hiding from reality is no longer possible.

Recent Comments